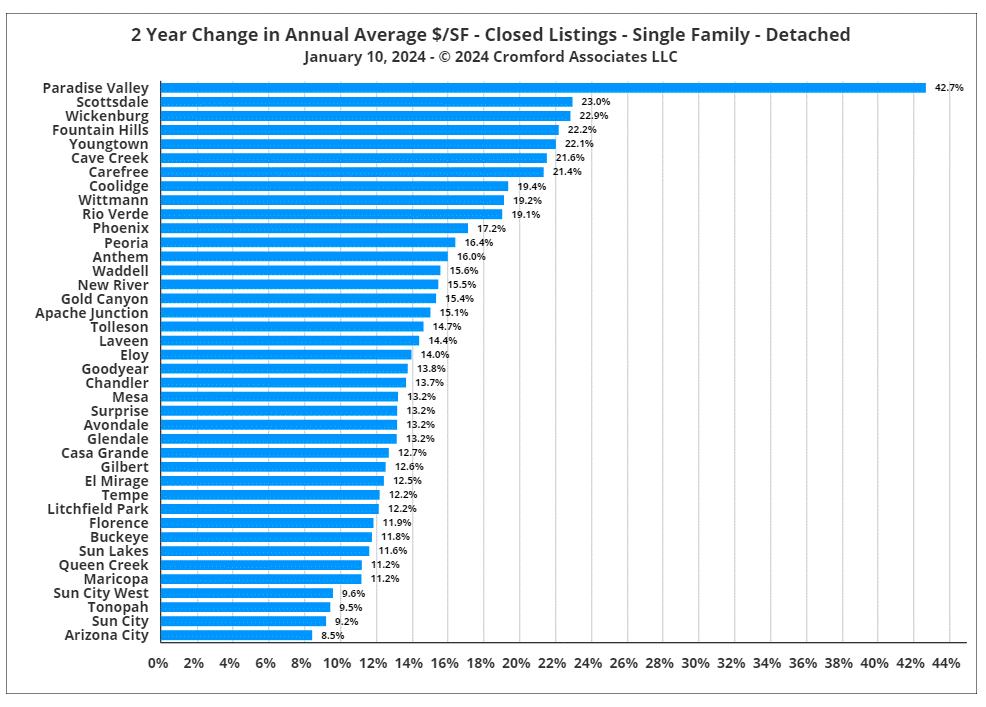

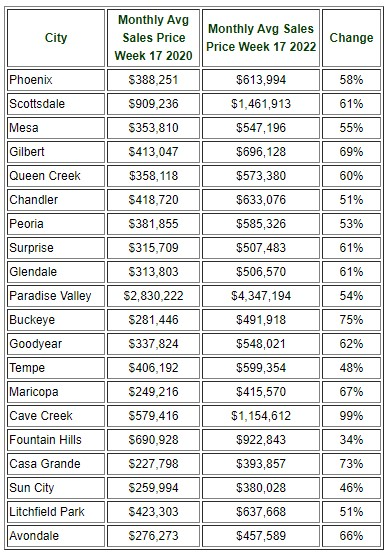

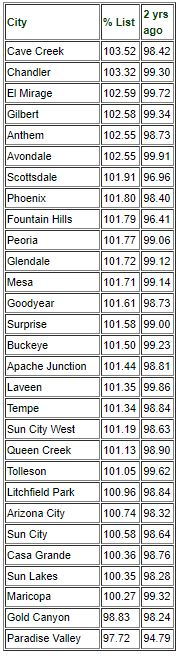

Here is what has actually happened over the past 2 years:

Aug 27 - The latest S&P / Case-Shiller® Home Price Index® numbers were published this Tuesday.

The new report covers home sales during the period April to June 2024. This means the typical home sale closed in mid May, more than 3 months ago. Please remember that Case-Shiller data is fairly old, even on the day it is released.

All 20 cities show rising prices for last month.

Comparing with the previous month's series we see the following changes:

Detroit +1.13%

Chicago +0.95%

Las Vegas +0.84%

Cleveland +0.76%

Atlanta +0.72%

Boston +0.68%

Miami +0.66%

San Diego +0.65%

Minneapolis +0.63%

Los Angeles +0.61%

Seattle +0.59%

Washington +0.58%

New York +0.56%

Charlotte +0.48%

Phoenix +0.42%

Dallas +0.39%

Denver +0.25%

Tampa +0.21%

Portland +0.13%

San Francisco +0.07%

Phoenix has risen from 19th to 15th places over the last month. The national average was +0.47% so Phoenix prices rose slightly less than the national average.

The North, Las Vegas and Atlanta remain strongest.

Comparing year over year, we see the following changes:

New York +9.0%

San Diego +8.7%

Las Vegas +8.5%

Los Angeles +8.2%

Chicago +7.0%

Detroit +7.0%

Miami +6.9%

Cleveland +6.7%

Seattle 6.7%

Boston +6.6%

Charlotte +6.4%

Washington +6.0%

Atlanta +5.1%

San Francisco +4.3%

Phoenix +3.7%

Tampa +3.1%

Dallas +2.3%

Minneapolis +2.0%

Denver +1.9%

Portland +0.8%

Phoenix dropped one place to 15th, and is still stuck in the bottom half on a year over year basis. All 20 of the cities are again showing positive price movement from one year ago with Denver and Portland once again at the bottom. Las Vegas is looking strong in both tables.

The national average is +5.4% year over year. Phoenix is below that percentage, and in a similar situation to the last four months.

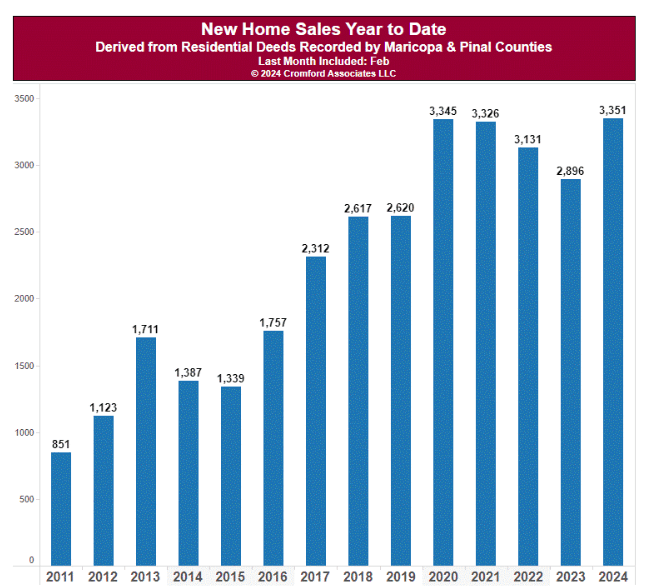

Aug 25 - 2024 has seen a rebound in the number of single-family building permits issued in Maricopa and Pinal counties.

So far (until the end of July) we have counted 18,498 single-family units which is up more than 40% from the same period last year. However it is not quite up to the booming levels of 2021 and 2022 when we counted 21,796 and 19,748 respectively. The re-sale market has been much weaker than the new home market and year-to-date closing volumes are down from 2023 - 45,937 as of the end of June 2024, which is down 4% from the same period last year. We do not often see the new home and re-sale markets so disconnected from each other.

Homebuilders are clearly optimistic about the market, especially given the Federal Reserve positioning on reduced interest rates. Many of the publicly traded developers saw there stock prices hit all-time highs over the last week.

Permits are up 39% in Maricopa county and up 43% in Pinal county. They are also up almost 38% for Arizona's 13 other counties.

The year-to-date permit counts by location are as follows:

Unincorporated Pinal County 2,849

Phoenix 2,331

Surprise 2,039

Buckeye 1,484

Unincorporated Maricopa County 1,205

Queen Creek 1,112

Peoria 1,098

Goodyear 1,092

Maricopa 883

Casa Grande 722

This list is very different from the re-sale market. Note that Mesa, Glendale, Scottsdale, Gilbert and Chandler didn't make the top 10.

The failure of San Tan Valley to incorporate means we have an extremely large number of new homes going into locations that are not managed by a city or town, but just the county administration. There is now a renewed effort to incorporate and a vote is scheduled for later this year to determine if this effort can proceed.

Florence is growing fast and is now receiving more permits than Gilbert and threatening to overtake Scottsdale.

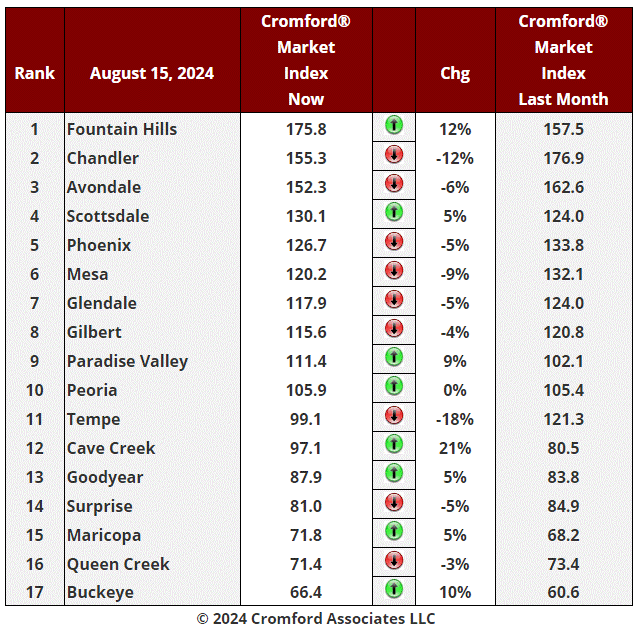

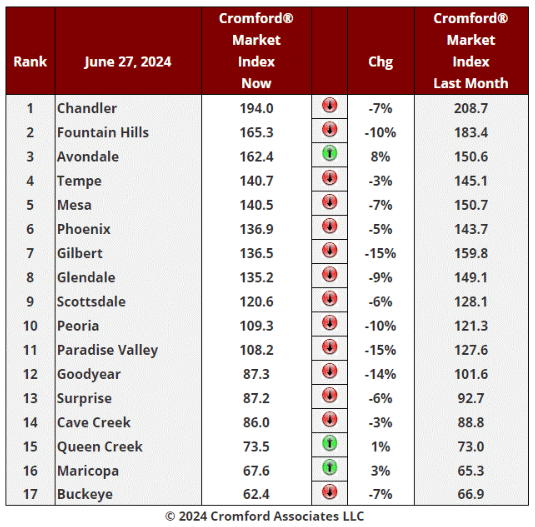

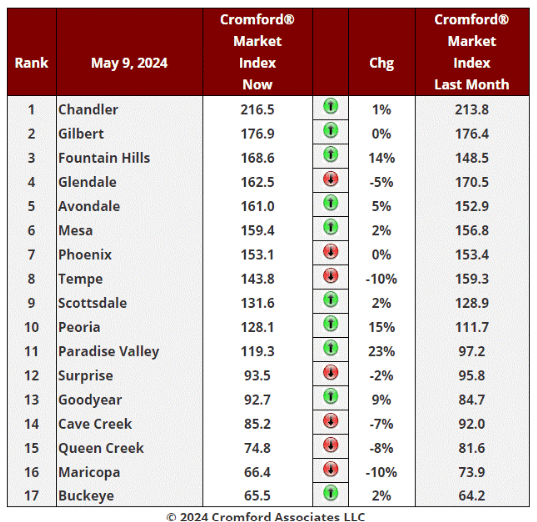

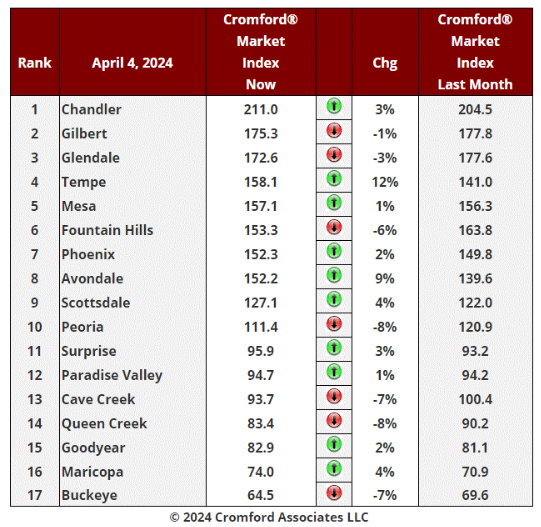

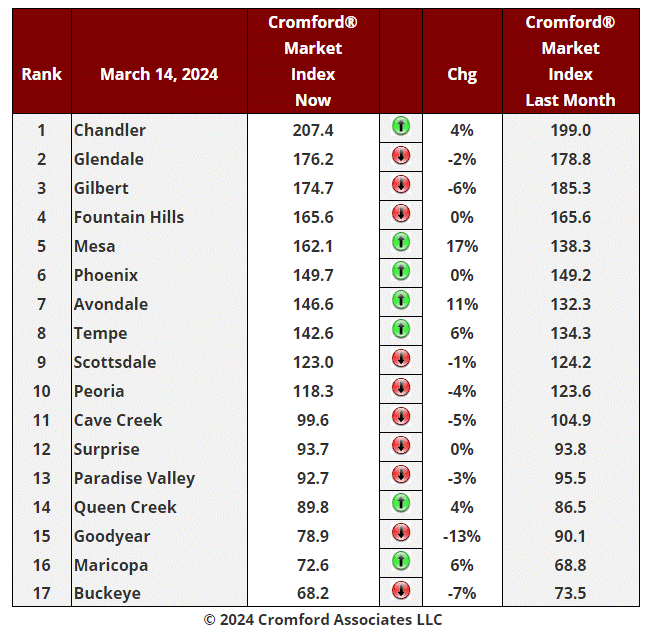

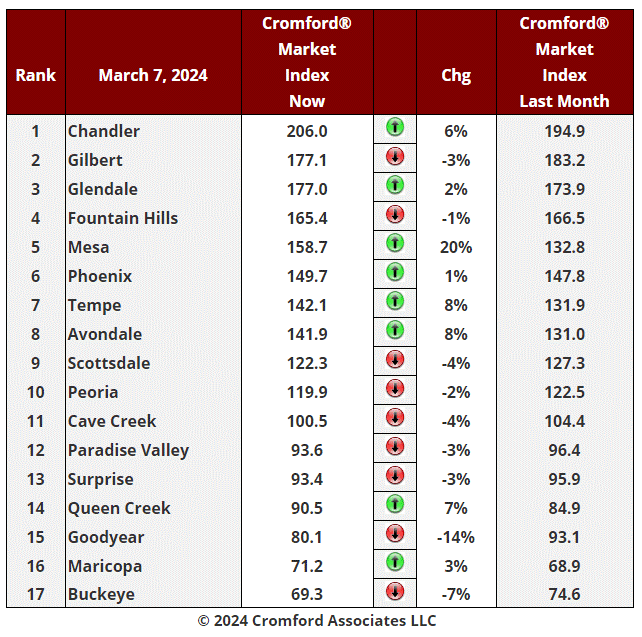

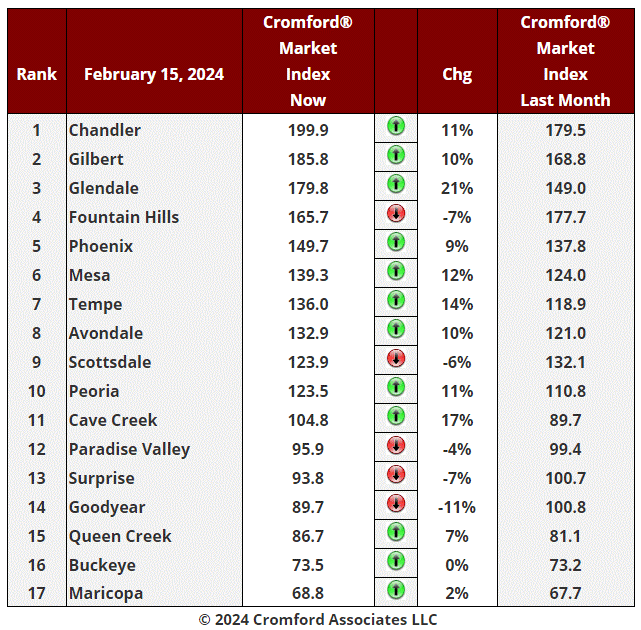

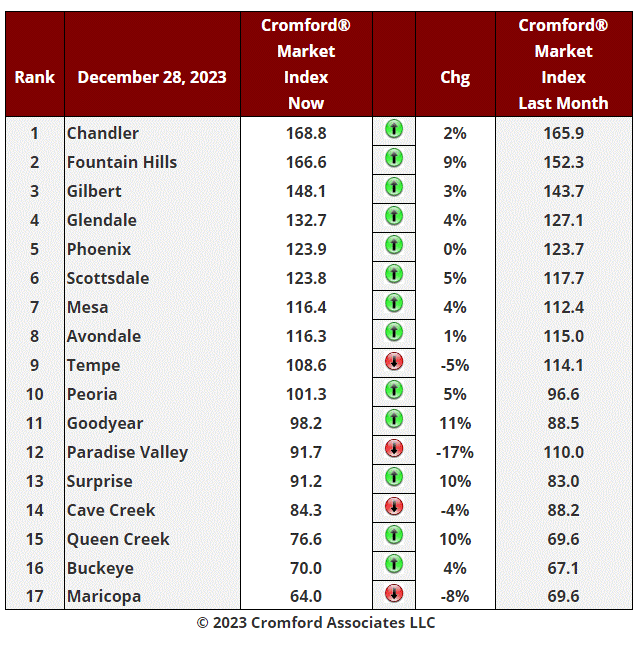

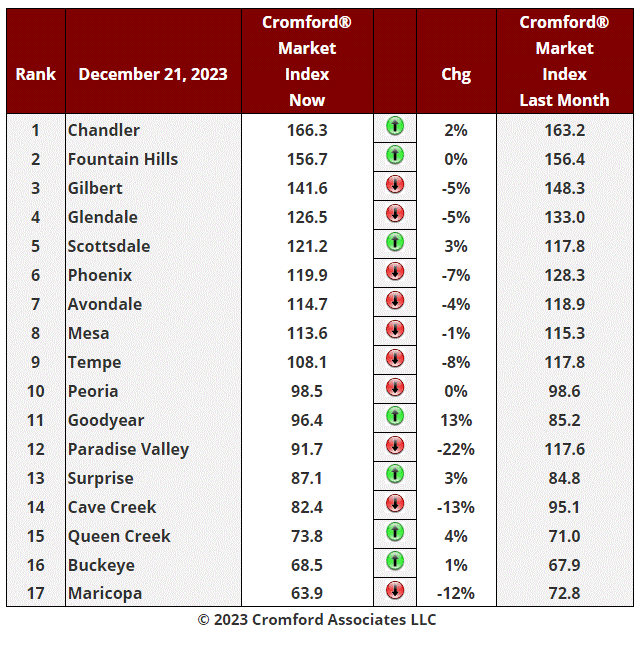

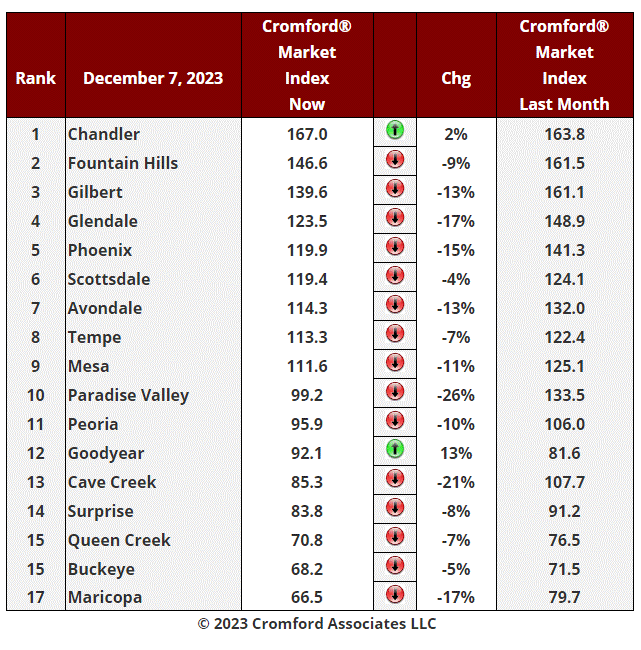

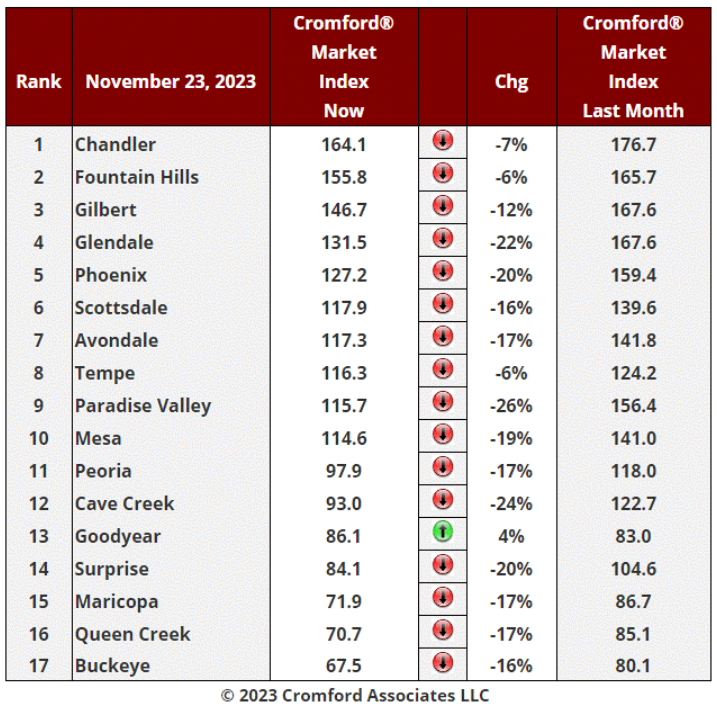

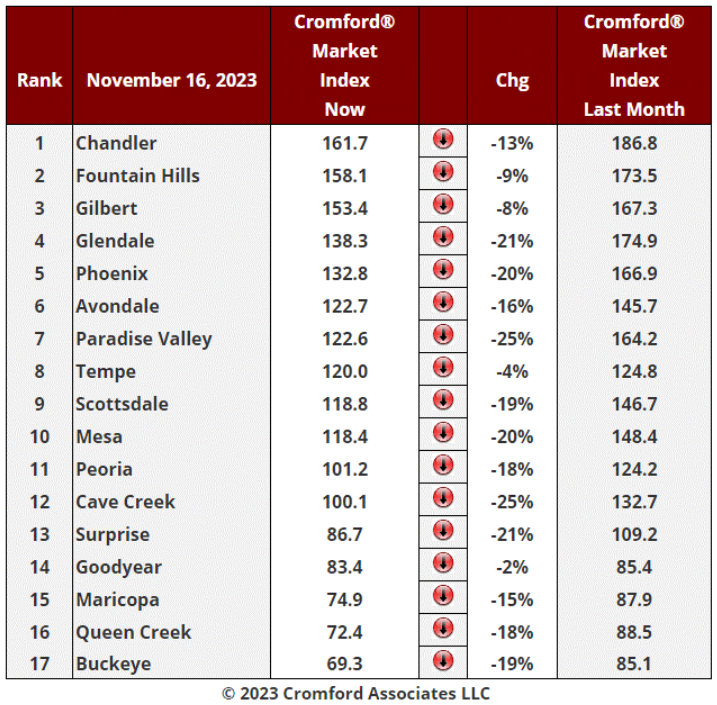

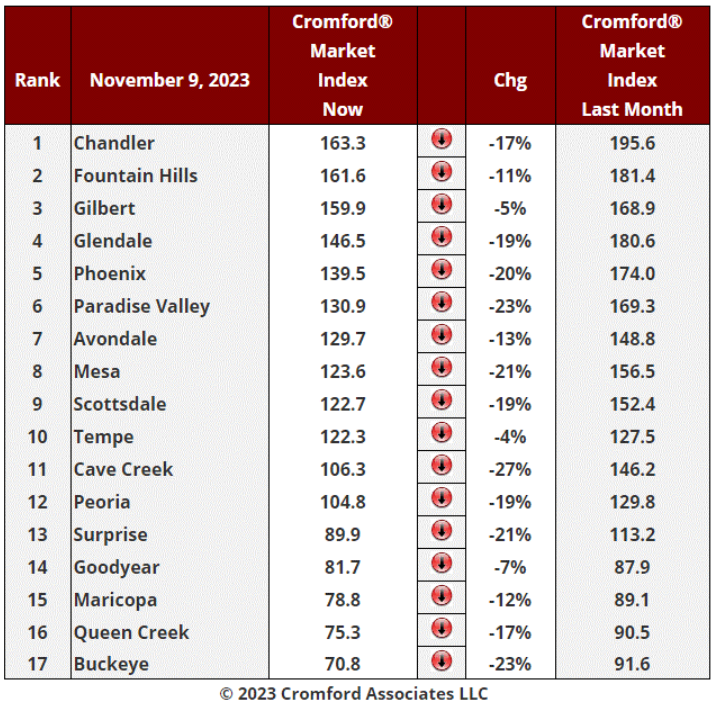

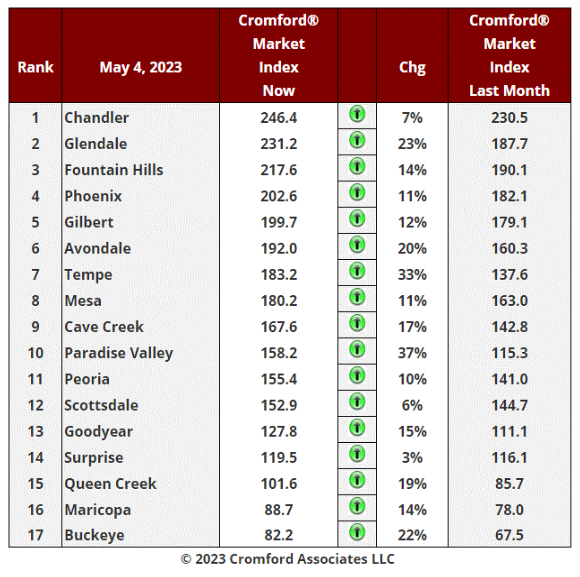

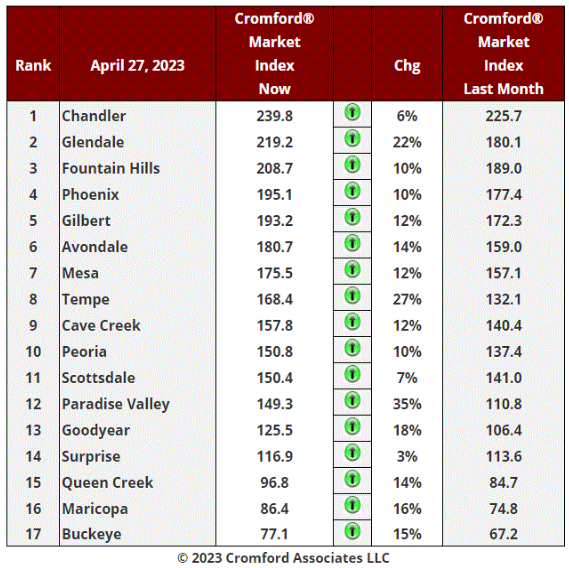

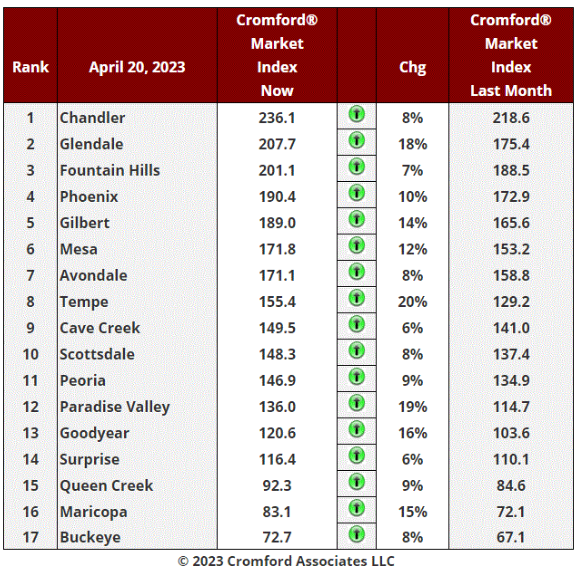

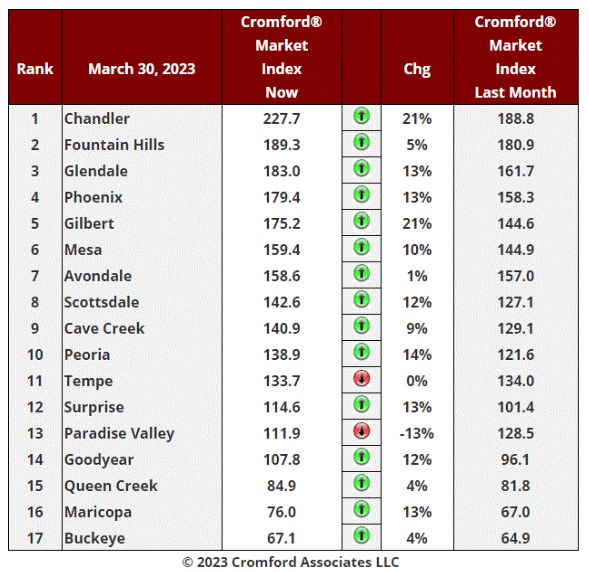

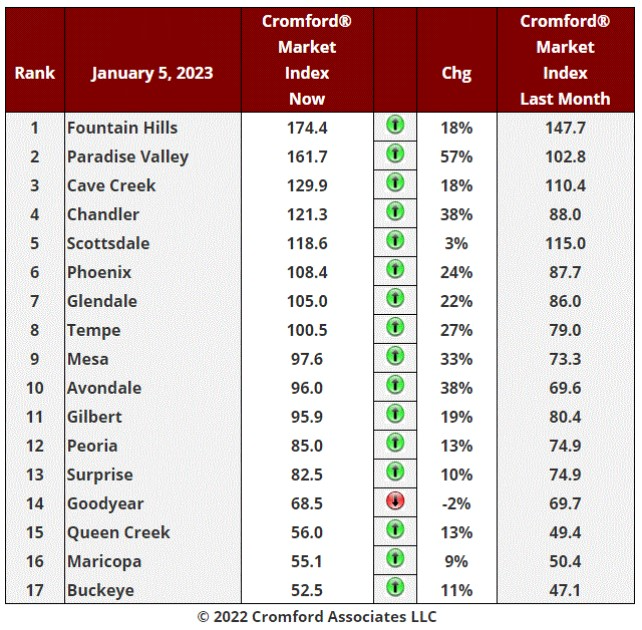

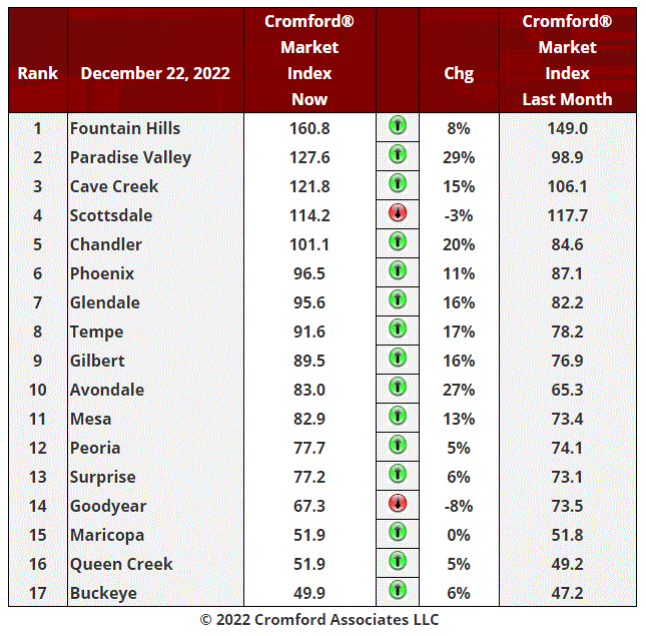

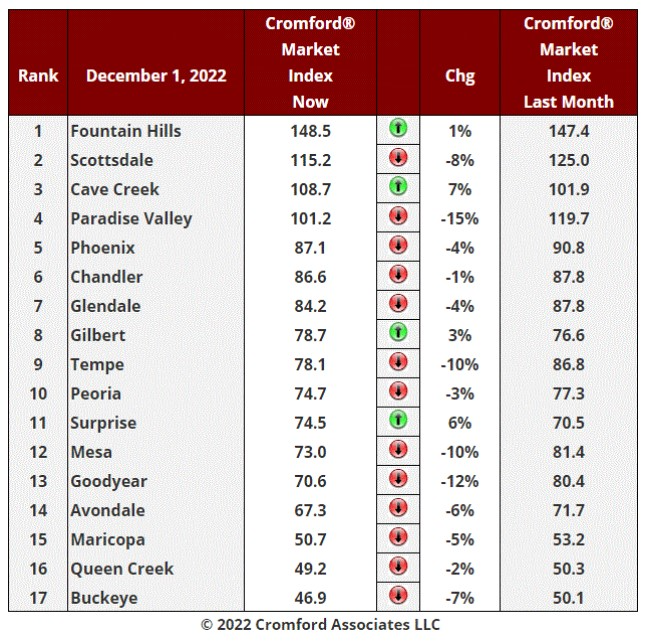

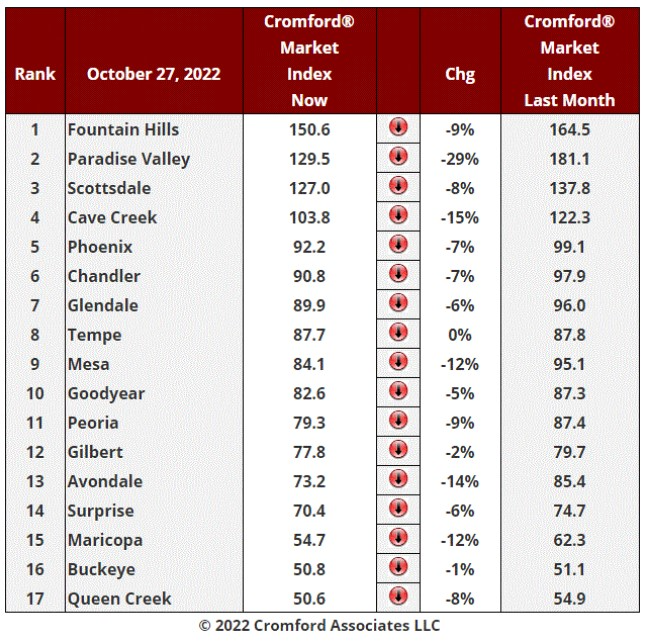

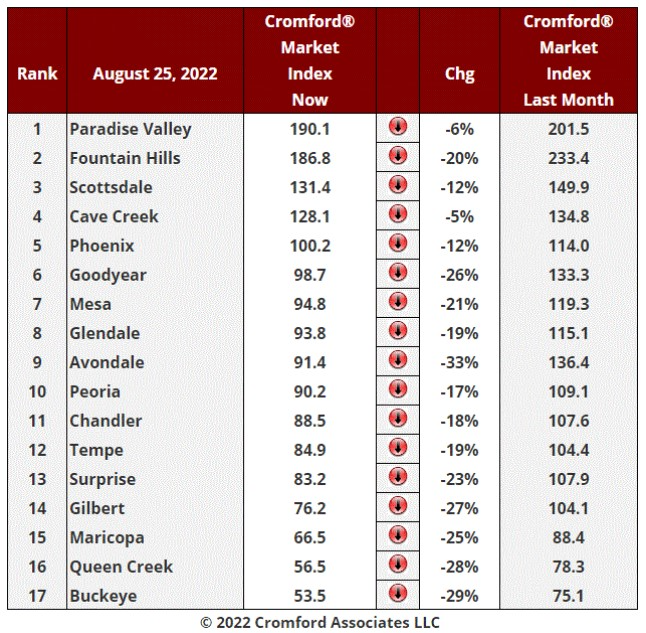

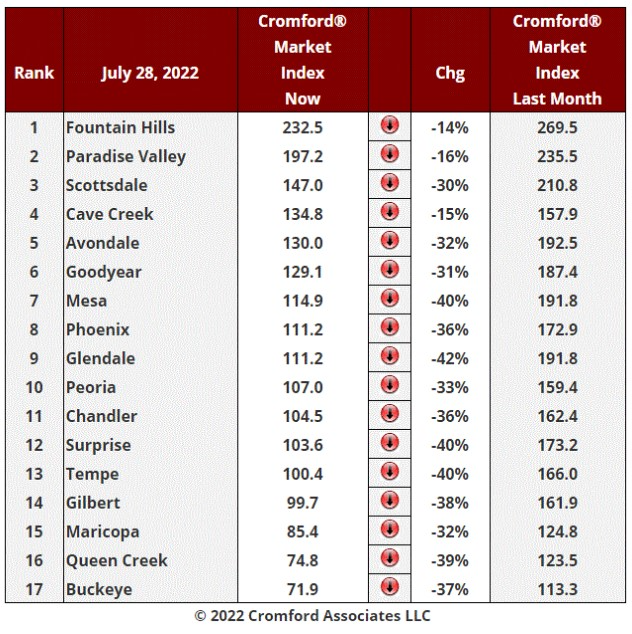

Aug 22 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

We are seeing more positive signs from a seller's perspective. There are 9 cities showing an increase in their Cromford® Market Index over the past month, up from 8 last week. We have 8 cities showing a decrease. That is a small majority going up and this is the first time we seen this situation since May 9.

The change is still painfully slow but it is real. The trend has reversed but is yet to gather any significant momentum.

The average change in CMI over the past month is +0.7%, our first positive change since May 23. Last week we saw -0.1%.

The market is starting to improve for sellers overall and I hope buyers took good advantage of their opportunity to negotiate harder over the last 3 months.

Cave Creek, Paradise Valley, Buckeye and Fountain Hills are showing the largest percentage gains. In addition, Scottsdale, Gilbert, Maricopa, Goodyear and Peoria are all up over the last month. The largest declines are still concentrated in the Southeast Valley (Tempe, Chandler and Mesa), but Avondale has weakened substantially too..

9 out of 17 cities remain seller's markets over 110. We have 3 cities that are balanced, while the remaining 5 are buyer's markets. 3 cities still remain over 140 while 3 remain under 75.

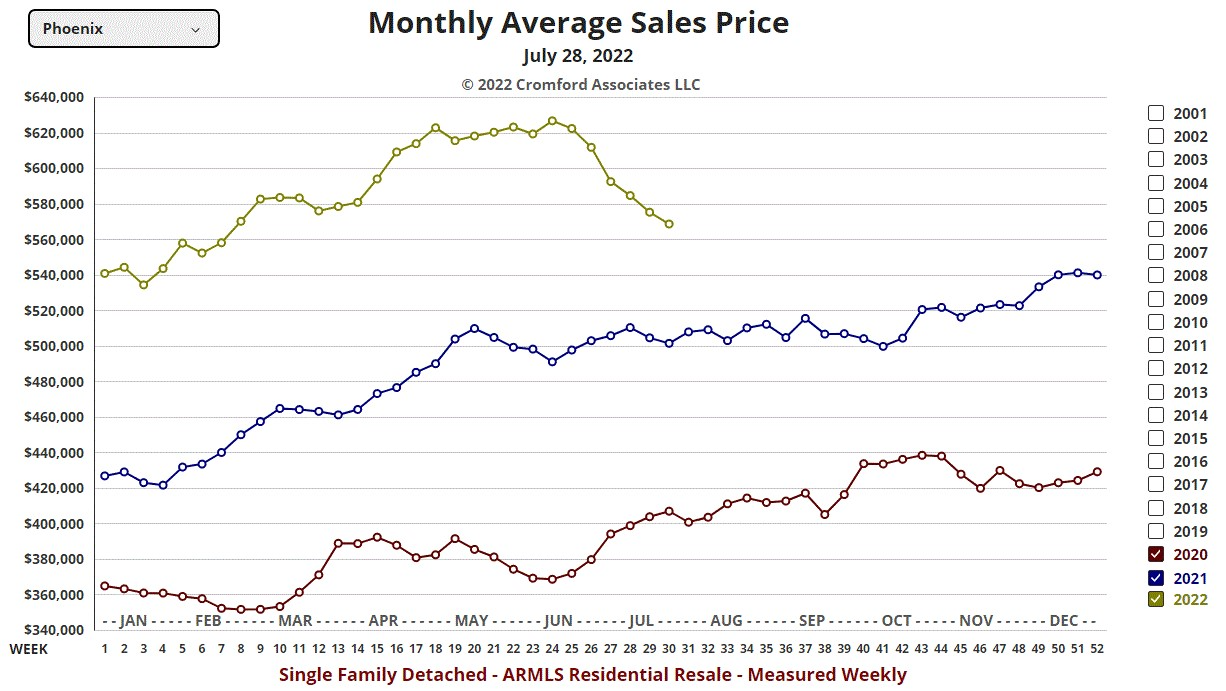

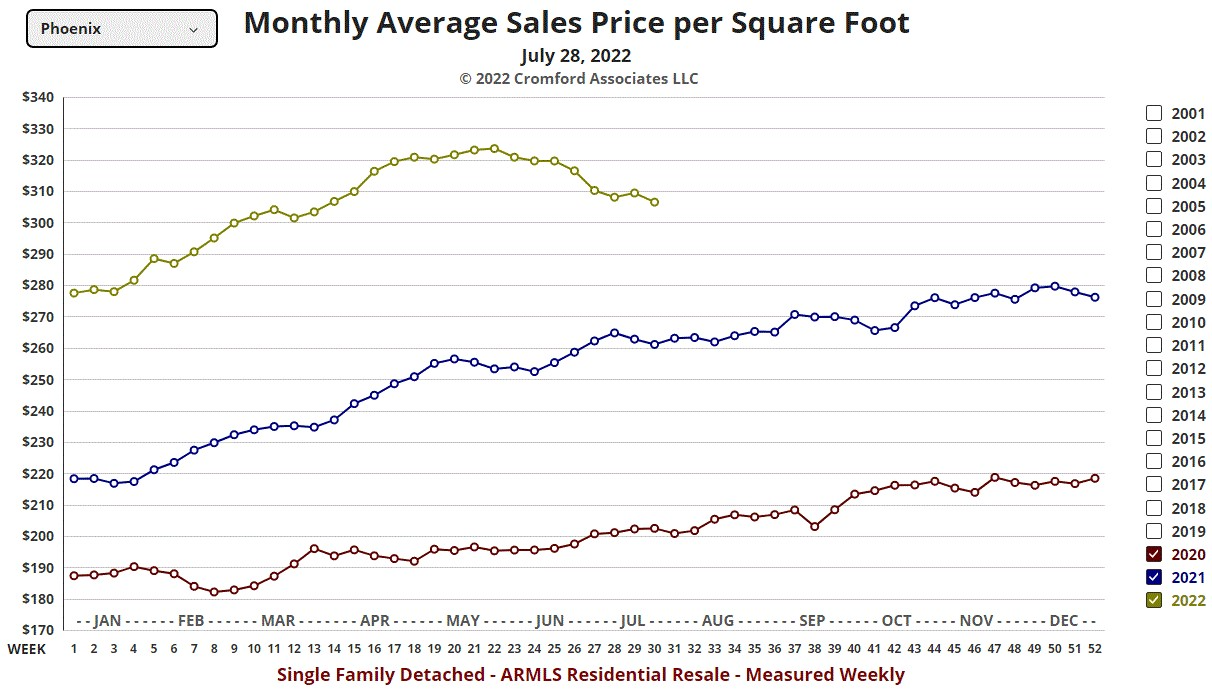

Aug 20 - Another way in which we can get distortions in the pricing averages is when the mix between Pinal County and Maricopa County changes dramatically.

Comparing April with July 2024, the number of closed sales in Pinal County dropped by only 0.7% from 877 to 871. But the closed sales in Maricopa County fell by more than 15% from 5,737 to 4,876. Because Pinal is much less expensive than Maricopa on average, the swerve in favor of Pinal brought pricing measurements substantially lower. The average $/SF in Pinal fell just 3.1% between April and July, but 6.9% in Maricopa and 7.2% for both counties combined.

These mix effects can be confusing and tend to happen during the third quarter of each year. The overall average drops sharply, but the fall in individual subsegments tends to be less dramatic.

In Pinal County, a much higher percentage of overall sales are new builds. Despite being brand new, these homes have a low average price per sq. ft because more of them are further out on land that was purchased relatively cheaply by the developer. We can see from the Tableau charts on Cromford® Public that new homes are cheaper than resales on a price per sq. ft. basis. This seems counter-intuitive, and it is not the case when you look at a small area. But taken across Greater Phoenix as a whole, new home $/SF is clearly lower then re-sale $/SF. This is because the distribution of new homes is not uniform. Most of them are going up on much cheaper lots in locations with more affordable pricing.

We have to put up with these distortions in the market between June and August and things don't really get back to the normal mix until the second half of September.

Aug 17 - We have mentioned many times that the high-end market tends to drop off substantially during the Summer months, causing all sorts of distortion in market averages, especially those related to price.

To illustrate how this happens, let us look at the figures for April versus July and compare the Northeast Valley with the rest of the Greater Phoenix market. We know that the bulk of luxury homes are situated in the Northeast Valley, which we will define as Carefree, Cave Creek, Fort McDowell, Fountain Hills, Paradise Valley, Rio Verde and Scottsdale. We are going to add Phoenix 85016 and 85018 and exclude Scottsdale 85257.

For this area the April single-family detached sales count was 662 and the July count was 440. This represents a unit volume decline of almost 34%. The average price per square foot also fell from $558.56 to $505.70, a decline of 9.5%.

For the rest of Greater Phoenix excluding the area defined above, the single-family detached sales count for April was 4,631 and the average $/SF was $262.36. In July the sales count was 4,267 and the $/SF was $254.26. So the sales declined only 8% and the $/SF only went down by 3%.

When we look at Greater Phoenix as a whole we see the weak contribution from luxury sales dragging down the $/SF all the way from $313.17 to $289.28, a drop of 7.6%, more than twice the decline seen in the market outside the Northeast.

Naturally we expect high-end sales to recover once the temperatures cool off, which will mean their contribution to the average $/sf will grow and average pricing will probably recover its stability.

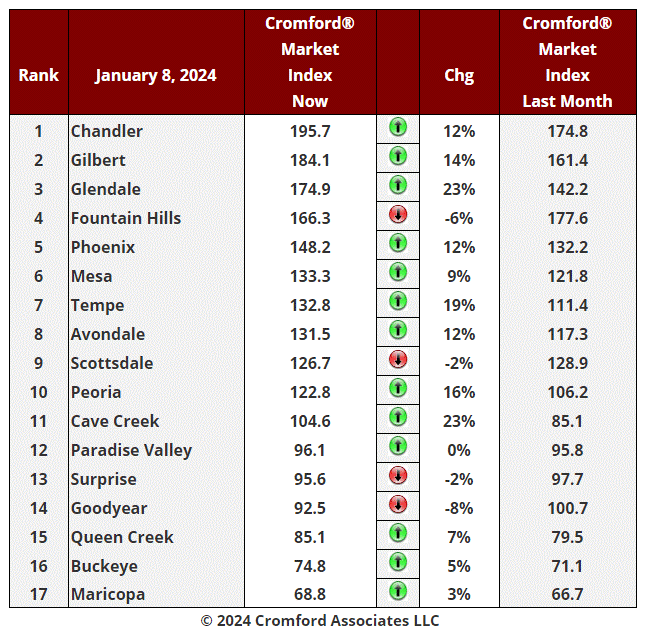

Aug 15 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

Aug 10 - The following observation was written in response to an interesting question from our long-term subscriber John Gluch.

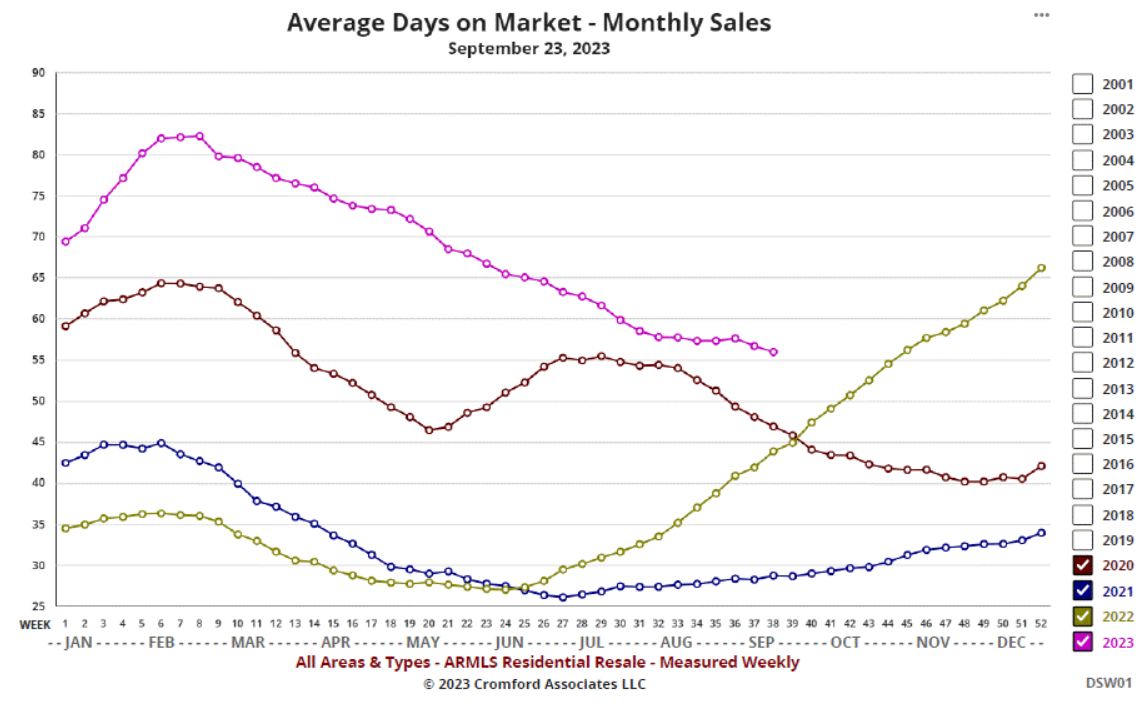

Days on Market is a very flawed measure that I do not pay very much attention to. There is little relationship between DOM and the Cromford® Market Index, which is designed to be a leading measure. DOM is a trailing measure and often points in the wrong direction for a long time compared with other indicators.

There are a couple of big reasons for DOM being less than useful:

1. Many agents will perform contortions to try to get their DOM counts reset to zero and the MLS has struggled to counter those measures in an evolutionary tug of war.

2. A significant percentage of agents place their listings in Active – UCB status when they get a contract signed. In the distant past this would normally be pending. This causes DOM to continue to accumulate and distorts the measurement in the other direction.

We prefer a different measure which is agent days to contract acceptance. This is shown in a Tableau chart below:

https://cromfordreport.com/member-only/tableau/new-contracts-vs-back-on-market.html

It is still flawed but not nearly as much. The latest number is 36 which is up sharply from 20 just 12 months ago. In fact, it is the highest reading for August since 2014, which was a particularly weak period for housing. This means listings are taking longer to get a contract accepted than in any August in the last 10 years. This may well match your current experience as an agent.

This measure tends to be influenced by seasonality with December and January producing high values, which need to be treated with caution.

When supply and demand are in balance, the CMI is around 100, but this happens much less than you might think. Over the past 24 years, we have tended to be mostly in a seller’s market and when we are not, we often have a buyer’s market. In buyer’s markets DOM values get very high, even well into the hundreds of days. Since we are rarely in a balanced market, sellers experiencing them tend to think they are worse than balanced, because they feel “worse than normal”. They ARE worse than normal because a normal market is unbalanced in favor of sellers. Balance and normal are not the same thing.

The last time we had a CMI below 100 was 4Q 2022. Average DOM for closed listings was then between 51 and 68. Today we are at 67, so in the same ballpark.

DOM for active listings is always much higher than DOM for closed listings because the active listings contain a higher percentage of luxury homes than the closed listings. These luxury homes spend much longer in active status and distort the reading to the upside.

Currently, I think a lot of buyers are in limbo, waiting for mortgage rates to fall further, as that is what all the media pundits are saying will happen later this year.

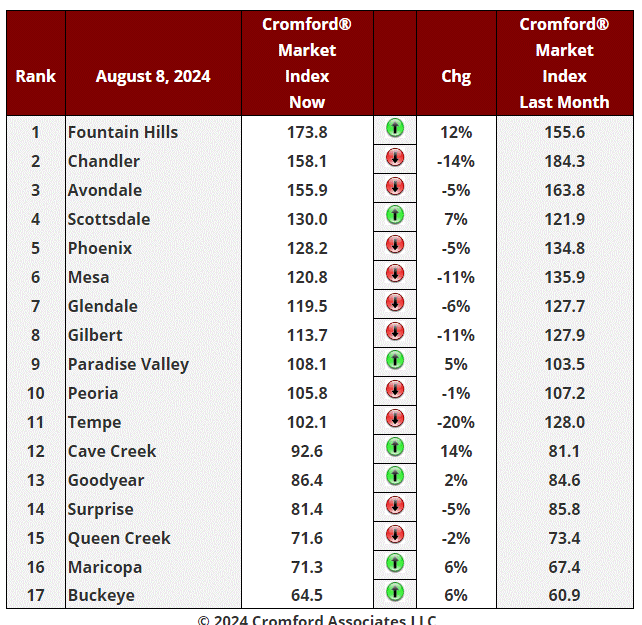

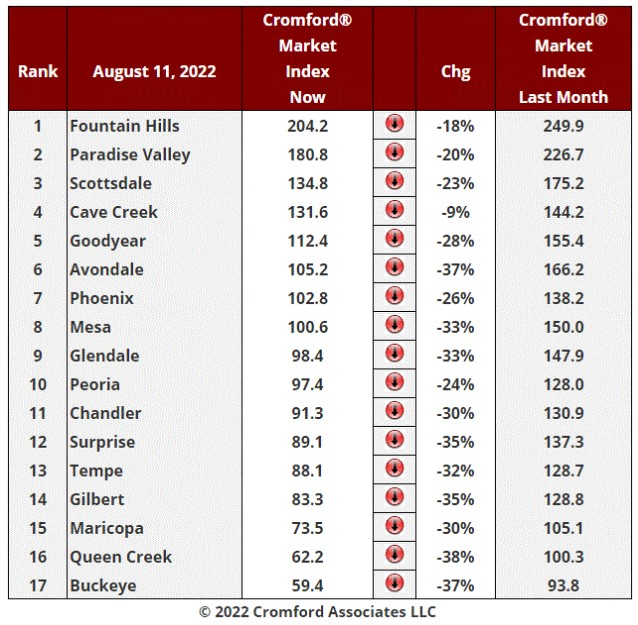

Aug 8 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

This table is starting to look a lot less negative. We have 7 cities showing an increase in their Cromford® Market Index over the past month, up from 5 last week.

The average change in CMI over the past month is -1.8%, a much smaller decline than the -4.4% we saw last week and continuing a positive trend that started three weeks ago. If we look at the change over the past week, we see an average of +0.4%. That's right - the average CMI went up slightly from August 1 to August 8.

Fountain Hills, Cave Creek, Scottsdale are showing the largest percentage gains, so it seems clear that the top end of the market is leading the resistance against the weaker market. Maricopa, Buckeye, Goodyear and Paradise Valley are all up over the last month. The largest declines are still concentrated in the Southeast Valley (Tempe, Gilbert, Chandler and Mesa). After a long stay at the top, Chandler has weakened dramatically and looks likely to be overtaken by Avondale and fall into third place.

8 out of 17 cities remain seller's markets over 110. We have 4 cities that are balanced, while the remaining 5 are buyer's markets. 3 cities still remain over 140 and Scottsdale is making an attempt to join them.

Aug 6 - Buyer's agent commissions are a hot topic right now (apologies if I am twisting the knife). As I am based in the UK these days, some subscribers might be interested to learn what fees a UK buyer's agent charges in a system where the sellers will never pay for a buyer's agent.

First it must be stated that buyer's agents are rare in the UK. The vast majority of transactions are conducted without the buyer having representation from an agent. They are expected to find a property and negotiate the price all on their own. There are plenty of estate agents, but they only help sellers and they are paid by the sellers from the proceeds of sale. They are clearly motivated to get the highest possible price in the shortest possible time. There are no obligations to disclose defects. From an integrity perspective, seller's agents are respected about as much as used car salespeople and politicians.

However there are some professional buyer's agents. They are generally used by clients who are looking for an expensive property - at least £500,000 and probably over £1 million (about $1,280,000). Their clients may be looking for something hard to find because it is unusual, or they may have no time to look for themselves. This is especially true if they are buying from outside the country. They usually operate in and around London. It is very hard to find a buyer's agent that will cover the more remote areas, such as where I live in County Durham.

It is up to the buyer and their agent to agree their commission. It will probably be different in every case. If I use one example - Henry Pryor & Co., their website states that they offer the following options:

1. A "pocket agent service" for a one-time charge of £1,000 ($1,280) including sales tax (VAT at 20%) - this is for response to questions and advice on how to negotiate with the seller. No active search is conducted.

2. A "buying service" fee as follows:

1. £600 per week pay-as-you-go for as long as it takes

2. A fixed up-front fee of £14,400 even for properties valued at £50 million or more

3. A one-time retainer of £2,400 plus 3% of the purchase price payable.

Henry Pryor discourages clients from using the third option. I can see why. Apart from probably ending up being more costly, it seems patently silly for a buyer's agent to be paid more if the buyer pays a higher price. You want your buyer's agent to be motivated to get the price as low as possible once you have found the desired property. That is one of the fundamental moral problems with the old system where selling agents offer a percentage of the price to a cooperating buyer's agent. The harder they work to negotiate a good deal for the buyer, the less they get paid in commission. You can see why the DOJ has problems with this system.

Important! Henry Pryor operates "dynamic pricing" which means their charges go up when they are very busy and they go down when times are quiet. This is to try to balance supply and demand for their agents (a bit like Uber surge pricing). Fees are documented in writing at the start of the process.

Personally, I think many UK buyers act foolishly if they don't use a buyer's agent, at least for a property over £1 million. The professional advice may prevent you buying a home with a fatal flaw and their negotiation experience means they can almost certainly save you more money than you will be paying in fees, unless you are already a superbly skilled negotiator with extensive real estate experience.

Buyer's agents can often find properties that are not yet on the market. This is extremely hard for buyers to do without an agent.

An advantage of being a buyer's agent in the UK is that your integrity is generally respected by all sides.

I hope this stimulates some ideas for agents in Arizona.

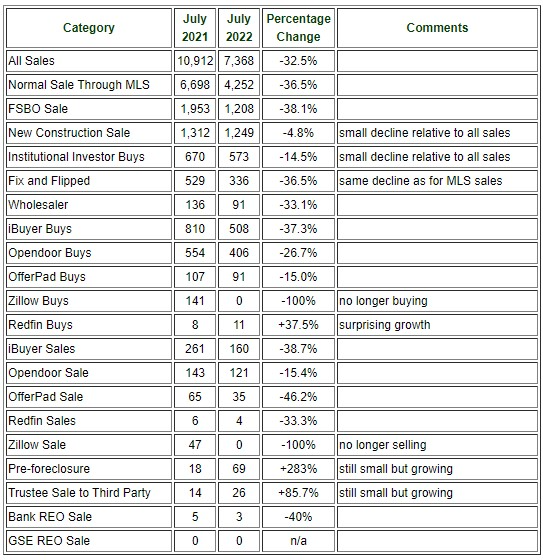

Aug 3 - The affidavits of value have been counted and analyzed for Maricopa County's July filings and here is what we found:

There were 6,360 closed transactions, up 4.6% from 6,081 in July 2023 but down 4.1% from June.

There were 1,378 closed new homes, up 1.9% from 1,352 in July 2023 but down 13% from June.

There were 4,982 closed re-sale transactions, up 5.4% from 4,729 in July 2023 but down 1.3% from June.

The overall median sales price in June was $467,545, up 0.5% from July 2023 but down 1.6% from June..

The re-sale median sales price was $450,000, up 1.1% from July 2023 but down 3.2% from June.

The new home median sales price was $506,240, down 5.1% from July 2023 but up 0.5% from June.

There were 22 working days in July 24 versus 21 in July 23, so the 4.6% rise in closings is more than explained by the 4.8% increase in the number of working days. In a reversal of long-standing trends, new homes grew only 1.9%, while resales grew 5.4%, modestly exceeding the change in working days..

New home market share dropped to 21.7% in July 2024, down from 22.2% a year ago.

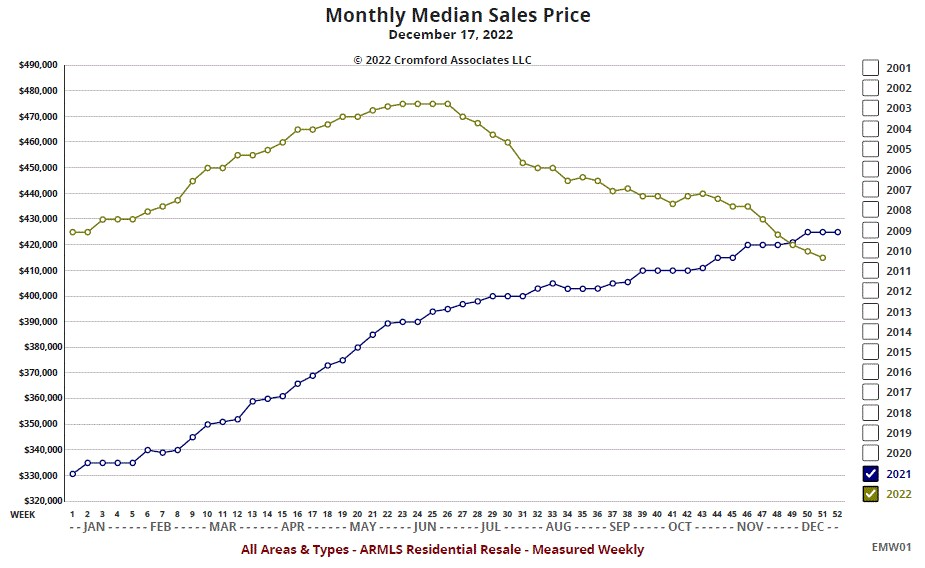

Prices were weak for re-sales, down more than 3% from a month earlier. The peak remains $486,000 achieved in May 2022, just before the iBuyers started their liquidation sales.

Overall we see an annual rise in the median sales price of only 0.5%, so well below the rate of inflation. This means the median home is cheaper than a year ago, when adjusted for inflation. The median new home is down more than 5% from a year ago, so cheaper than last year even before adjusting for inflation.

Given that median household incomes have risen substantially over the last year, affordability in Maricopa County has improved, though there is no sign yet of this leading to strengthening demand. It would make sense to assume that potential buyers are waiting for mortgage rates to come down. Recent pronouncements by the Federal Reserve suggest such a change is on the cards in the short-term.

These numbers are for single family and townhouse / condo homes.

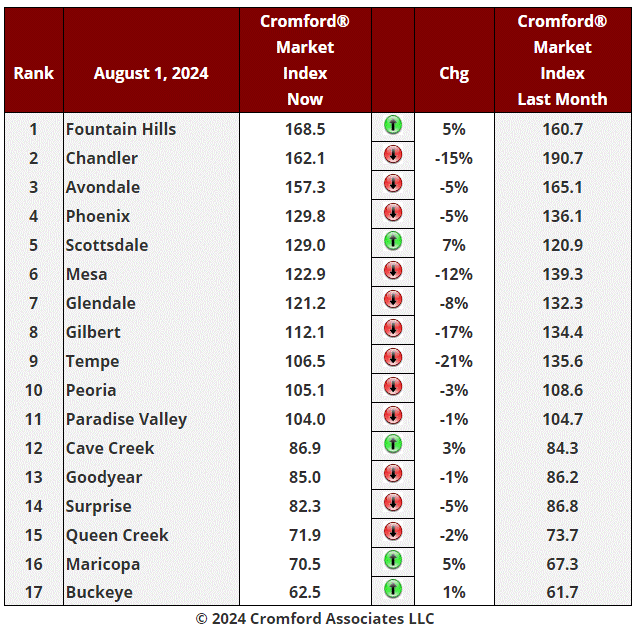

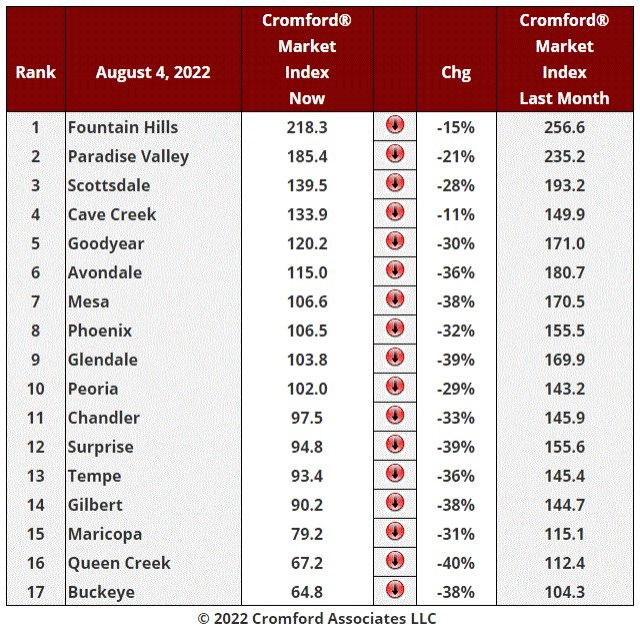

Aug 1 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

This table is starting to look a little less negative. We have 5 cities showing an increase in their Cromford® Market Index over the past month, up from only 2 last week.

The average change in CMI over the past month is -4.4%, smaller than the -5.4% we saw last week and continuing a positive trend that started a couple of weeks ago.

Scottsdale, Fountain Hills, Maricopa, Cave Creek and Buckeye are the risers while the largest declines are concentrated in the Southeast Valley (Tempe, Gilbert, Chandler and Mesa). After a long stay at the top, Chandler has finally been overtaken by Fountain Hills.

8 out of 17 cities remain seller's markets over 110.. We have 3 cities that are balanced, while the remaining 6 are buyer's markets. 3 cities still remain over 140.

Jul 30 - The latest S&P / Case-Shiller® Home Price Index® numbers were published this Tuesday.

The new report covers home sales during the period March to May 2024. This means the typical home sale closed in mid April, more than 3 months ago. Please remember that Case-Shiller data is fairly old, even on the day it is released.

All 20 cities show rising prices for last month.

Comparing with the previous month's series we see the following changes:

Cleveland +1.75%

Detroit +1.71%

Seattle +1.43%

New York +1.26%

Las Vegas +1.20%

Minneapolis +1.14%

Chicago +1.13%

Washington +1.12%

Atlanta +1.00%

Charlotte +0.99%

Los Angeles +0.98%

Denver +0.87%

Tampa +0.79%

Dallas +0.75%

San Diego +0.72%

San Francisco +0.69%

Miami +0.67%

Boston +0.53%

Phoenix +0.42%

Portland +0.33%

Phoenix has overtaken Portland to climb one place to 19th. The national average was +0.86% so Phoenix prices rose less than half the national average.

Many areas enjoyed exceptionally strong rises, especially in the North and on the Atlantic Coast. Apart from Seattle, the Pacific Coast has slowed down.

Comparing year over year, we see the following changes:

New York +9.4%

San Diego +9.1%

Las Vegas +8.6%

Los Angeles +8.4%

Miami +7.6%

Chicago +7.5%

Cleveland +7.5%

Boston +7.2%

Charlotte +7.2%

Seattle +7.1%

Detroit +6.8%

Washington +6.1%

Atlanta +5.7%

Phoenix +4.4%

San Francisco +4.2%

Tampa +3.3%

Dallas +2.6%

Minneapolis +2.4%

Denver +2.1%

Portland +1.0%

Phoenix stayed at 14th place yet again, and is still stuck in the bottom half on a year over year basis. All 20 of the cities are again showing positive price movement from one year ago with Denver and Portland once again at the bottom. Las Vegas is looking surprisingly strong.

The national average is +5.9% year over year. Phoenix is below that percentage, and in a similar situation to the last three months.

Jul 29 - With the NAR Commission Settlement imminent, there is widespread uncertainty and confusion across the industry about how it will all play out.

The uncertainty is exemplified by the decision of the CMLS not to offer best practices advice to its members. The Council of Multiple Listing Services (CMLS) represents 225 different MLS providers across the country, and has urged its members to have "thoughtful conversations" and "pick your own adventure". This means we are likely to see different implementations in different geographies. The confusion is also exemplified by the NAR's FAQ web-page on the settlement where the number of FAQs has risen to more than 100, putting it well into TLDR territory.

Recent surveys have shown that commission rates have varied little across the regions of the USA with buyer's agents earning between 2.6% and 2.8% historically while listing agents have earned 2.8% to 3.2%. In recent months these numbers have fallen a little to 2.4% to 2.8% and 2.8% to3.0%. There is a lack of consensus on what these numbers might look like over the next year.

The impact of the settlement is likely to be much more significant to real estate agents than the housing market itself, though some effects are certainly possible. Our feeling is that these would tend to reinforce existing trends rather than change them.

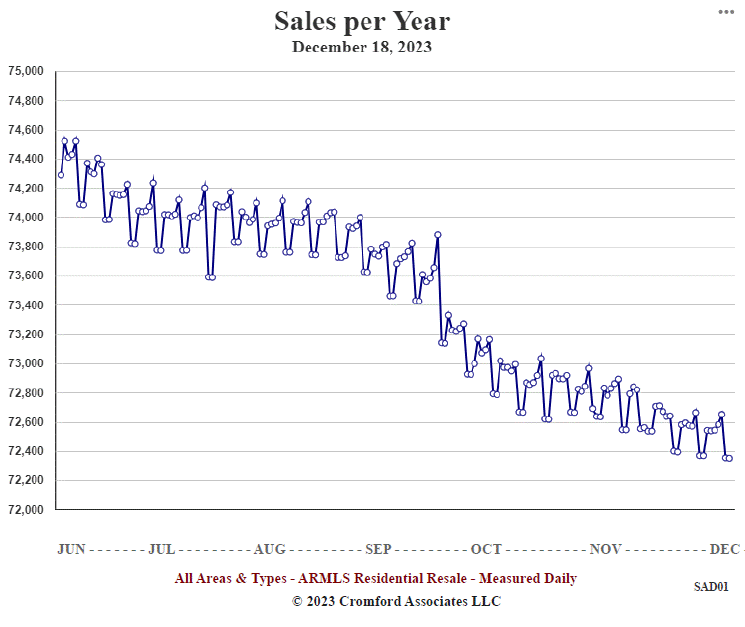

We are at a low level of closing activity with only 70,473 closed listings over the past 12 months across all areas & types. This is down from 74,060 a year ago and well below the long-term average of 85,101. We are still a long way above the extreme low point of 48,491 that we witnessed on June 30, 2008, so there is room to fall. The uncertain legal and procedural situation is not likely to increase volumes and we may instead see the declining closing rate continue for some time before easing mortgage rates are able to stimulate a recovery.

New home sales may benefit from having their agent commissions clearly communicated and this could continue to grow their percentage share of sales. Builder margins may also benefit from an increasing number of transactions where no external agent is involved, saving them from paying any compensation to a buyer's agent or broker and allowing them to compete harder on gross prices.

The DOJ has stated that "real estate commissions in the USA greatly exceed those in any other developed economy" and their Antitrust Division seem determined to lower them. They want buyer's agent commissions set between the buyer and buyer's agent and not determined at all by the seller or the selling agent. It is possible that the NAR settlement does not go far enough for the Antitrust Division to be satisfied that this objective will be achieved.

While it is true that real estate commissions are higher in the USA than elsewhere, the duties performed by both buyer and listing agents are usually more extensive than in most other countries. It seems likely that when the dust settles, buyers will end up paying lower commissions than those paid in the past on their behalf by the seller, but buyers will also be getting a lot less advice and support during the buying process. This is not necessarily to their advantage since a small error in buying can have major financial consequences. These can outweigh any small difference in commission paid.

Clients tend to pay far more for legal services in the USA than in foreign countries too, but driving down the price of legal advice will not necessarily improve or even maintain the quality of that advice.

As in many walks of life, you tend to get what you pay for.

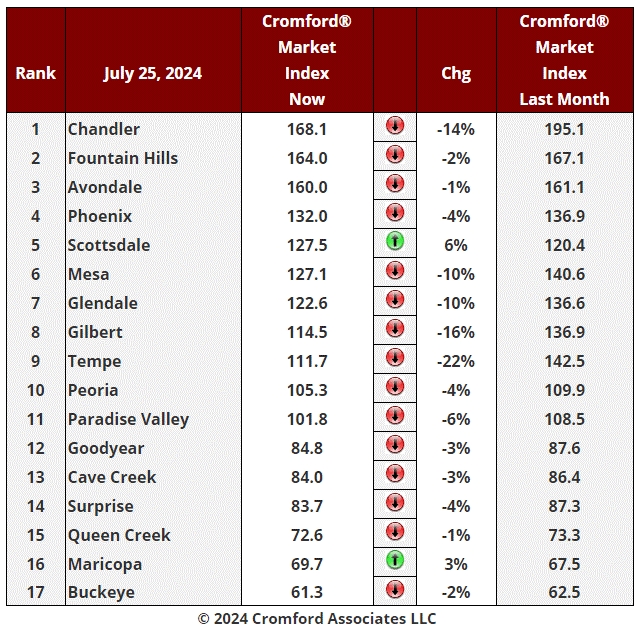

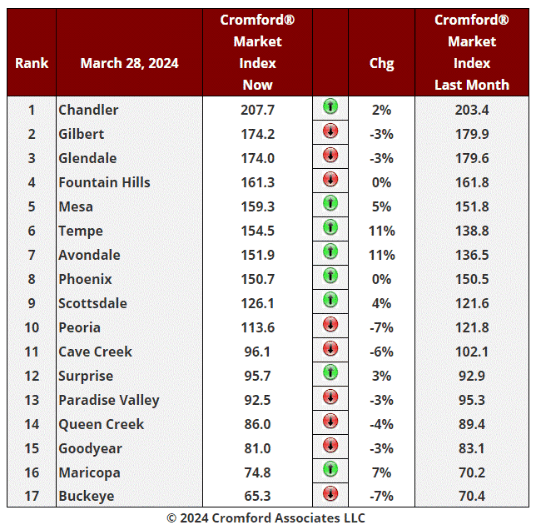

Jul 25 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

At first sight this looks bad. We have only 2 cities showing an increase in their Cromford® Market Index over the past month, half as many as last week. Avondale and Queen Creek have reversed course leaving Scottsdale and Maricopa alone. 15 have declined, so the vast majority have deteriorated for sellers. However most of these only fell by a small percentage. Former high-fliers Tempe, Gilbert and Chandler show the biggest falls.

After a second look, things look a lot better. The average change in CMI over the past month is -5.4%, a smaller fall than the -6.7% we saw last week. The rate of decline has definitely changed direction and this is a positive sign for the market. Things are deteriorating more slowly.

9 out of 17 cities remain seller's markets over 110, though that looks unlikely to last much longer for Tempe and Gilbert. We have 2 cities that are balanced, while the remaining 6 are buyer's markets. 3 cities still remain over 140.

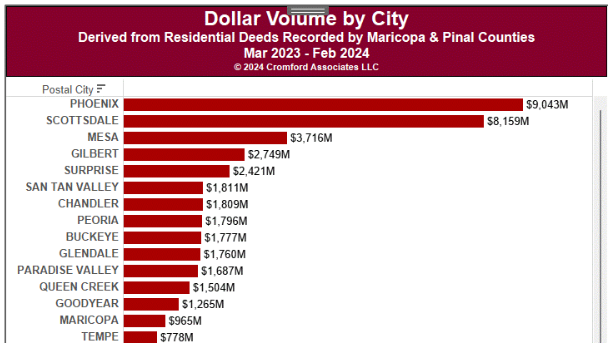

One of the largest markets by dollar volume (Scottsdale) has improved by 6% over the last month. Given that we are in the middle of the slowest season for luxury homes, this is another encouraging sign for that market.

Jul 22 - Throughout this site we tend to use nominal dollars when expressing sale prices. Most people do the same. Yet this can be a little misleading if we are thinking about how expensive homes are today compared with 24 years ago.

The average $/SF for January 2001 was $99.04 across Greater Phoenix for all dwelling types. In June 2024 the same measure was $299.44. On the face of it, prices have increased by 202% and are now over 3 times what they were at the start of 2001. However this is not a very fair comparison, since the dollar of 2001 would buy you a lot more stuff than it does today. It was worth 79% more than the dollar in June 2024, based on the Consumer Price Index..

The chart below compares the average $/SF over time - in green using the nominal dollars we are all familiar with. The blue line shows the same average $/SF but expressed in 2001 dollars. We used the Consumer Price Index to make the adjustment for each month between 2001 and 2024.

We can see that homes are certainly more expensive (on a price per square foot basis) than in 2001 - but only up by 69% in "real terms", not 202% as suggested by the nominal dollar amounts.

We can also drawn some other interesting conclusions:

Home prices in real terms were below Jan 2001 levels throughout the period Sep 2008 to Apr 2015. That was 7 years in which you could pick up a bargain.

Home prices in real terms are still significantly lower today than at the peak of May 2022.

Home prices in real terms are similar to those at the late stages of the bubble in the first half of 2006.

Home prices in real terms are similar to those at the end of 2021.

The 2 big boom periods were quite short in duration - mid 2004 to mid 2005 and mid 2020 to mid 2022.

The 1 big bust period was also quite short - from early 2007 to early 2009.

The two booms were quite different in nature, since the first was followed by a long period (2006 to 2011) with a huge excess of inventory for sale, which the second was followed by a period in which inventory remained below normal. This is why we have have two booms and only one bust.

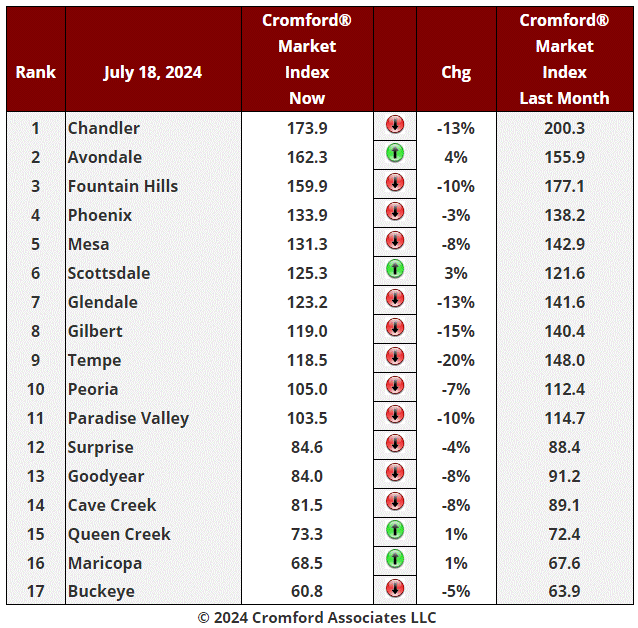

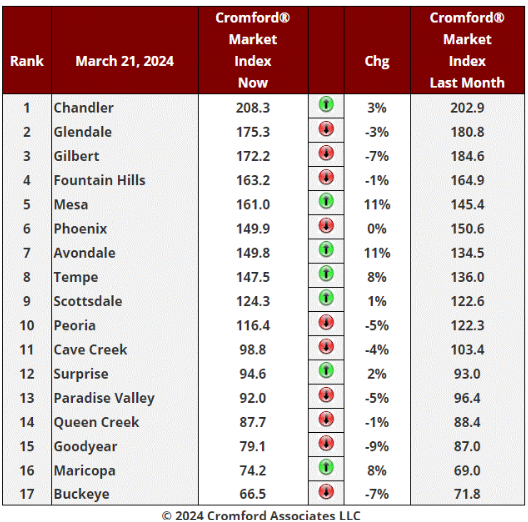

Jul 18 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -6.7%, a smaller fall than the -7.2% we saw last week. The rate of decline has changed direction and this is a mildly positive sign for the market.

We have 4 cities showing an increase in their Cromford® Market Index over the past month, with Scottsdale joining Avondale, Queen Creek and Maricopa. 13 have declined, so the majority have still deteriorated for sellers. The 4 improving cities have only risen by a small percentage, so nothing much to celebrate there.

We have a long list of cities that moved substantially in favor of buyers: Tempe, Gilbert, Glendale, Chandler, Fountain Hills and Paradise Valley. The Southeast Valley features strongly in this list.

9 out of 17 cities remain seller's markets over 110. We have 2 cities that are balanced, while the remaining 6 are buyer's markets. However only 3 remain over 140 and 2 of these are falling swiftly.

Mortgage rates are currently in a slow downward trend, which is likely to improve demand, if only gradually. Supply is much higher than last year, but still well below normal by long-term standards.

We have a balanced and rather insipid market overall, with volumes stuck at very low levels, which is not good for real estate professionals. However the idea that we are poised for some sort of drastic market correction is ludicrous. None of the conditions necessary for significant price falls are in place. Mortgage delinquency is low, sellers are motivated but not desperate and supply is not running far ahead of demand, as it did in 2006.

The increasing flexibility from sellers that a balanced market brings will cause list prices to fall, but is not likely to have much effect on final closing prices. The present weakness in pricing is a seasonal effect which almost always brings us an unfavorable sales mix between June and September. This is because the luxury market is only half-awake during these months, while investors remain very active.

Jul 17 - A pretty reliable indicator of the health of the market is the percentage of list achieved by closed listings. This can be measured every day for the past month, quarter or year and if the number is falling then the market is weakening, or vice versa. If the market turns around to the upside then the monthly percentage will start to exceed the annual percentage. Although it is reliable, it is substantially slower to react to changes in the market than other indicators like the contract ratio or the Cromford® Market Index.

Today we see the average for all areas and types standing at 97.64%. That tells us little on its own, but can be extremely meaningful when compared with numbers from the past.

The long term average is 97.38% (2001-2024). This suggests that the market is slightly stronger than average, but not by very much. Last month was 97.81%, so we are in a short-term falling trend.

One year ago, the monthly percentage was 98.06%, so noticeably stronger than the present value. However the present value is still above the long term average and not a cause for alarm. The market is softening but it is doing it very slowly. There is nothing here to support the idea that a crash is happening or imminent.

The highest we have ever measured is 101.94%. This occurred on April 20, 2022. This was when iBuyers and institutional investors were towards the very end of their massive acquisition spree. Interestingly, we did not get so high during the height of the housing bubble. The top reading for that period was only 99.55%. This is because the crash was not caused as much by over-paying but more by over-borrowing. Massive debts were taken on that had no hope of ever getting repaid and those debts were assigned triple A ratings by debt rating agencies. That was unusual and is unlikely to happen again during our lifetimes.

The lowest percentage recorded is 93.82%, which was on May 2, 2009.

A reading below 97% is a red flag and this occurred on 5 September 5, 2006. Much later than some signals but well before prices started to fall dramatically. In recent times, this falling below 97% occurred on December 1, 2022, but it quickly recovered from below 97% by February 25, 2023, and has stayed above 97% ever since.

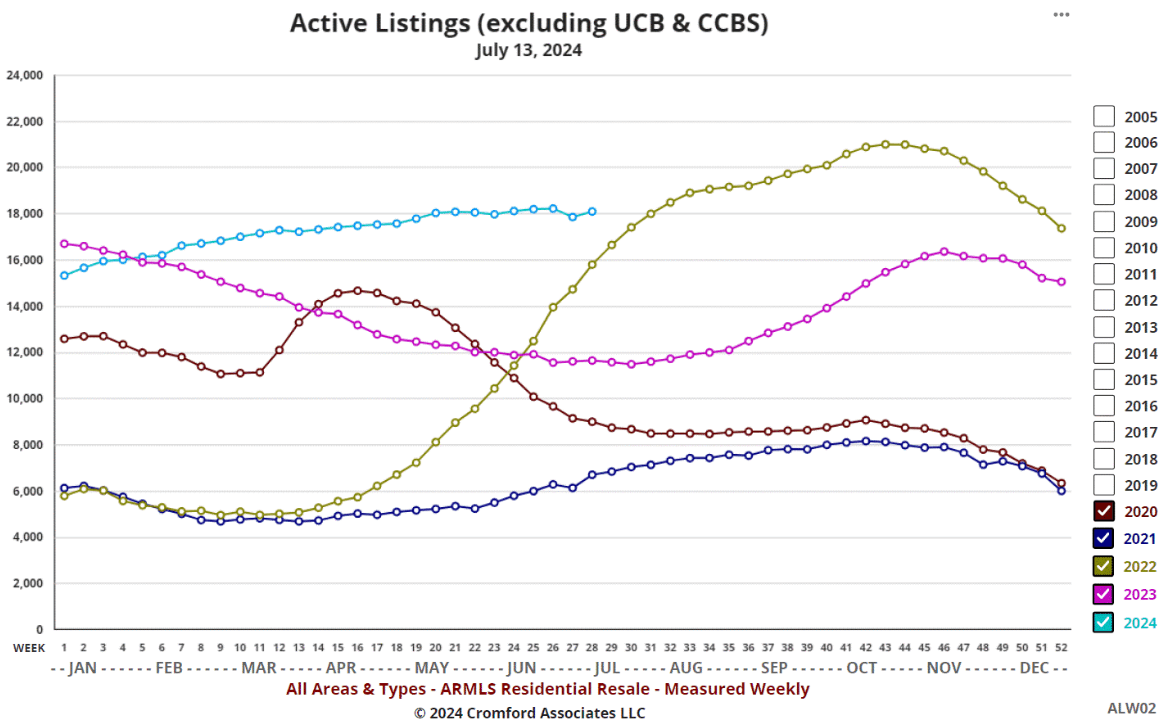

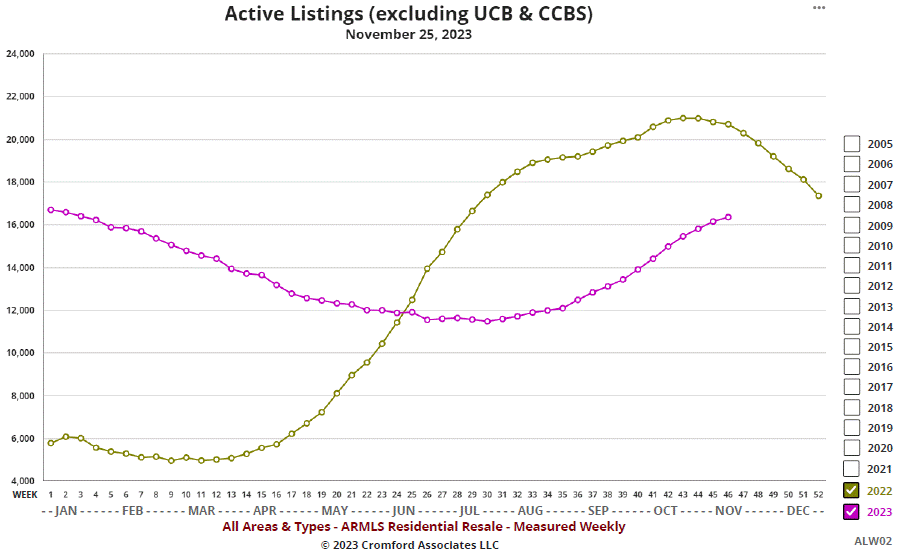

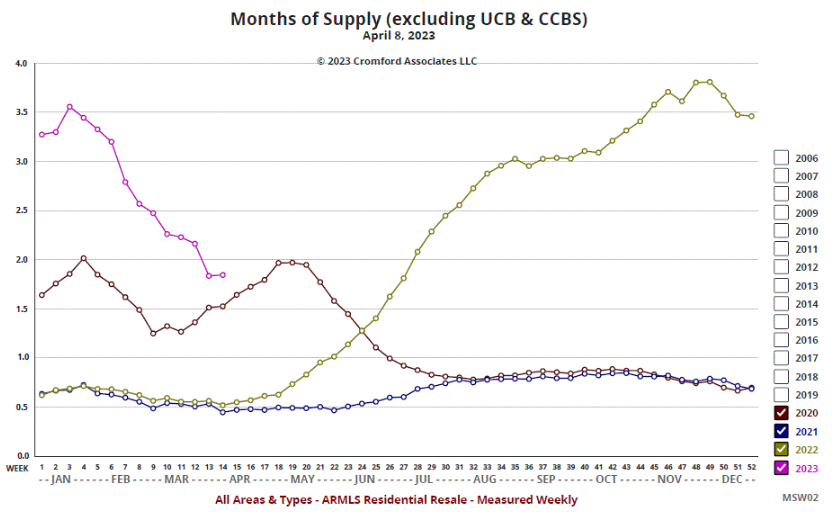

Jul 13 - The number of active listings had been rising since the start of the year but since May has reached a plateau, as can be seen in the turquoise line below:

The number is struggling to reach much beyond 18,000, which is about 75% of what we would consider normal. Meanwhile demand is continuing to fall and is almost 25% below what we would consider normal.

The combination of these means weak supply and weak demand are almost exactly in balance and the only detectable trend is demand weakening further.

If there is no change in these trends then we can expect the Cromford® Market Index to fall below 100 for the first time since January 2, 2023.

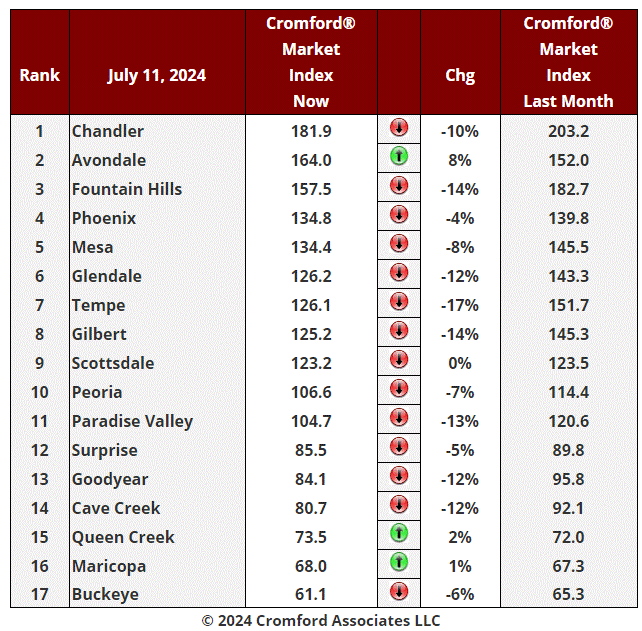

Jul 11 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -7.2%, a larger fall than the -6.9% we saw last week. However the rate of decline is slowing. In other words a -0.3% change is better than than the -0.8% we measured last week. If this trend is repeated then we could see the monthly deterioration reduce fairly soon.

As we saw during the previous 2 weeks, we only have 3 cities showing an increase in their Cromford® Market Index over the past month, while 14 have declined. The 3 improving are the same as last week, but only Avondale has improved by a decent percentage.

We have a long list of cities that moved substantially in favor of buyers: Tempe, Gilbert, Fountain Hills, Paradise Valley, Goodyear, Cave Creek, Glendale and Chandler.

9 out of 17 cities remain seller's markets over 110. We have 2 cities that are balanced, while the remaining 6 are buyer's markets. However only 3 remain over 140.

Not much has changed since last week and although the market is close to balance there is currently little sign that it will deteriorate to the point where we have a buyer's market overall.

The benign CPI data released this week has had a relatively small downward effect on mortgage rates, but a supercharged upward effect on the share prices of home builders. For example, KB Home rose more than 10% in hope of improved market conditions if the Federal Reserve starts to lower rates.

Overall supply looks like leveling off, bringing an end to the upward trend that has been in place since the beginning of the year. Without an excess of inventory, any improvement in demand caused by falling interest rates could translate to the CMI changing direction. However this is currently just a possibility and yet to be proven. We will certainly be reporting on it should we find solid evidence. Stay tuned.

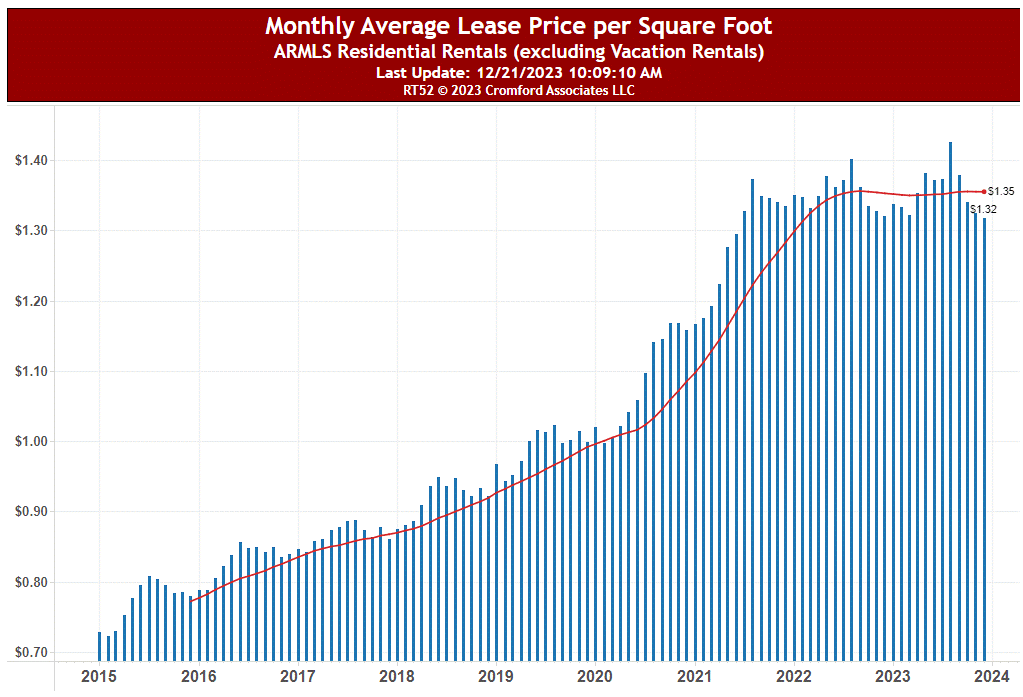

Jul 10 - The implementation of Rental Beast is potentially good news for us because we should have more rental listings entering our database. For statistics, a larger sample size usually leads to better quality statistics.

However this assumes that the incoming data is of high quality. At the moment we are suffering from major bugs in the ARMLS rental system that are causing data loss and some incorrect field contents. Huge numbers (more than 25,000) of listings have lost their parcel number, which is a crucial piece of information on which we base a lot of our assumptions about the property. In addition the relationship between city and county has become uncertain. Many Tempe listings are currently being placed in Cochise County, for example. Weird.

I am confident this will all get sorted out in good time, but at the moment you will need to be aware that the number of errors in the source data exceeds our ability to clean them with our daily process. This does not affect the overall statistics in our Tableau charts on rentals, but it means that applying some of the filters may give misleading results.

Please treat rental data with extra caution until we can give the all-clear signal again.

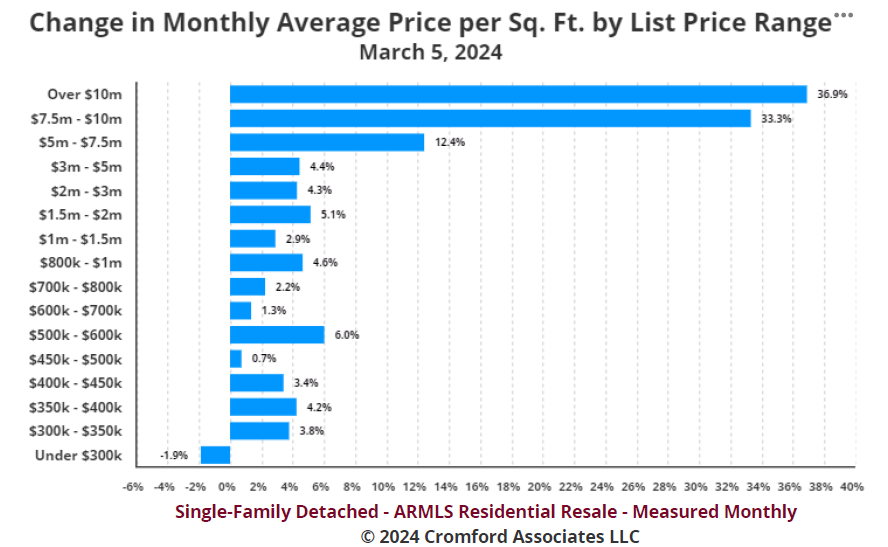

Jul 8 - We have been studying the contract ratios for various price ranges and comparing the readings on July 1 2024 with those for the same date in 2023 and 2022.

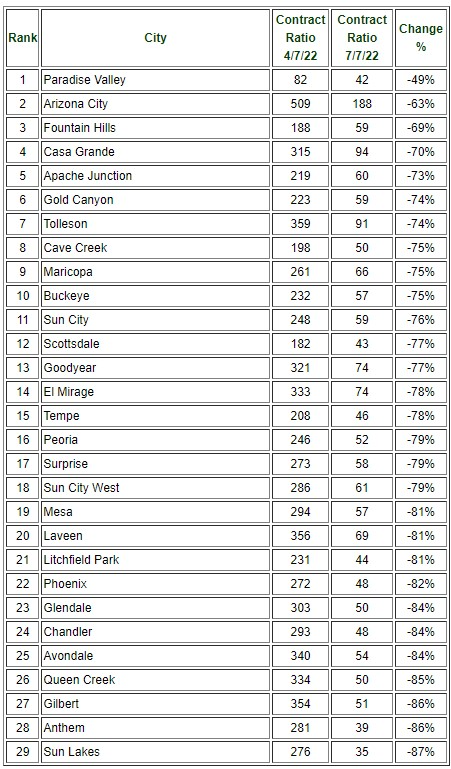

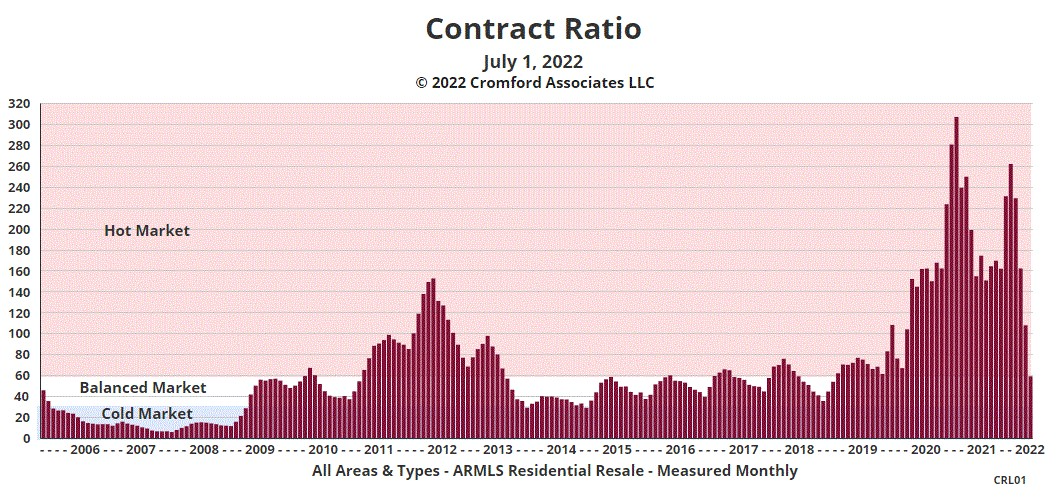

In July 2022 the rapid rise in interest rates had caused panic to rush through the market and contract ratios had collapsed from much higher June 2022 levels. The low to mid price ranges were worst affected.

By July 2023 the market had recovered to a remarkable degree and the low supply drove contract ratios back to hotter levels, especially at the lowest end of the market.

In July 2024, we are back to a softer market, with supply and demand in balance. Some price ranges are stronger than they were 2 years ago - for example Under $300K and $400K - $500K, but most are weaker than in 2022.

We note that the segment over $10m is unique in that it is hotter than it was last year and the year before. But between $800K and $10M the luxury price ranges are much cooler than in both prior years.

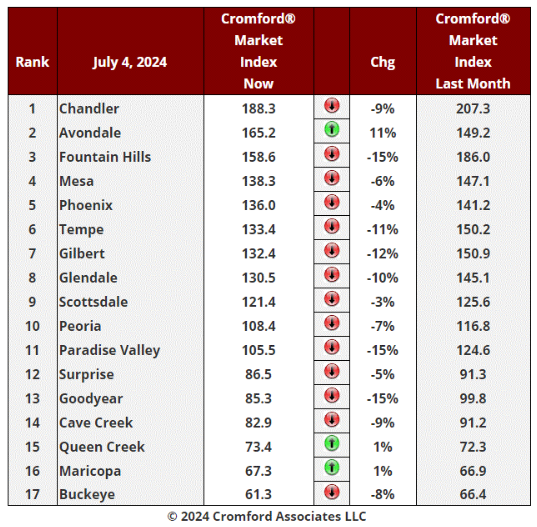

Jul 4 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -6.9%, a steeper fall than the -6.1% we saw last week . This is exacerbating the downward trend that started 7 weeks ago.

Like last week we only have 3 cities showing an increase in their Cromford® Market Index over the past month, while 14 have declined. The 3 improving are the same as last week, but only Avondale has improved by a large percentage.

We have a much longer list of cities that moved substantially in favor buyers: Paradise Valley, Goodyear, Fountain Hills, Gilbert, Tempe and Glendale.

9 out of 17 cities remain seller's markets over 110. We have 2 cities that are balanced, while the remaining 6 are buyer's markets. However only 3 remain over 140.

The situation is very similar to last week, but Buckeye is now only a shade over 60 and is exhibiting increasing signs of weakness.

Jul 3 - The affidavits of value have been counted and analyzed for Maricopa County's June filings and here is what we found:

There were 6,633 closed transactions, down 13% from 7,665 in June 2023 and down 15% from May.

There were 1,584 closed new homes, down 4% from 1,657 in June 2023 but up 1% from May.

There were 5,049 closed re-sale transactions, down 16% from 6,008 in June 2023 and down 20% from May.

The overall median sales price in June was $475,000, up 0.9% from June 2023 and unchanged from May.

The re-sale median sales price was $465,000, up 3.3% from June 2023 and up 1.1% from May.

The new home median sales price was $503,934, down 2.9% from June 2023 and down 3.2% from May.

Closing counts look very poor when compared with last month, as well as with a year ago. New homes closings were slightly weaker, falling 4% compared to a year ago, but re-sales were down by a massive 16%.

New home market share bounced back to almost 24% in June 2024 up from 20% last month.

Prices were surprisingly weak for new homes, down almost 3% from a year ago. Re-sales managed to show a rise of 3.3% for the year. Overall we see a rise in the median sales price of under 1%, so below the rate of inflation.

These numbers are for single family and townhouse / condo homes.

Jul 1 - The number of single-family detached homes available for sale in active ARMLS listings has increased by 57% in Greater Phoenix since this time last year. This additional supply in the face of chronically depressed demand has given rise to a weaker market which is currently very close to balance. Despite this, some segments are still seller's markets while other strongly favor buyers.

There are some price ranges which have seen larger increases in supply. These are:

Below $300K - up by 94%

From $300K and $350K - up by 64%

From $400K to $450K - up by 76%

From $500K to $600K - up by 77%

From $1.5M to $2M - up by 64%

From $5M to $7.5M - up by 59%

The lowest increases have been in the following price ranges:

From $700K to $800K - up by 31%

From $2M to $3M - up by 28%

From $7.5M to $10M - up by 35%

Jun 29 - There are still plenty of building permits being sought for new single-family homes. There were 2,740 issued in May for Maricopa and Pinal counties, which is is up 22% compared with May 2023 when we counted 2,246.

This brings the year-to-date total to 13,689 for the first 5 months of 2024. While this is less than for all 11 years from 1998 to 2008, it is the third highest total since 2007 and is up 56% from 2023.

Those who are selling re-sale homes will have much more competition if they are in an area which has lots of new construction going on. This is one of the reasons why the CMI is below 80 in locations such as Buckeye. Maricopa and Queen Creek. There are lots of both new and re-sale homes available in those locations and buyers have been showing a strong preference for new over re-sale for the past few years.

In more central locations, there are relatively few vacant land areas for developers to build on. This helps keep a lid on supply in places like Chandler, Tempe, Phoenix and Glendale. All these areas have CMIs over 130 at the moment, so they remain seller's markets.

Jun 27 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -6.1%, a steeper fall than the -5.0% we saw last week . This is increasing the downward trend that started 6 weeks ago. As sellers compete with each other, price reductions are still increasing in both size and frequency.

This week we only have 3 cities showing an increase in their Cromford® Market Index over the past month, while 14 have declined.

Avondale is the biggest mover in favor of sellers. We have a much longer list of cities that moved substantially in favor buyers: Paradise Valley, Gilbert, Goodyear, Peoria and Fountain Hills.

9 out of 17 cities remain seller's markets over 110. We have 2 cities that are balanced, while the remaining 6 are buyer's markets.

Jun 25 - The latest S&P / Case-Shiller® Home Price Index® numbers were published this Tuesday.

The new report covers home sales during the period February to April 2024. This means the typical home sale closed in mid March, more than 3 months ago. Please remember that Case-Shiller data is fairly old, even on the day it is released.

A big turn-around has taken place in the last 2 months. We have all 20 cities showing rising prices for last month. The Pacific coast had another remarkably strong month.

Comparing with the previous month's series we see the following changes:

Boston +2.16%

San Francisco +2.00%

Seattle +1.98%

Cleveland +1.84%

Detroit +1.80%

Chicago +1.72%

Minneapolis +1.37%

Denver +1.35%

Los Angeles +1.34%

Atlanta +1.28%

New York +1.27%

Las Vegas +1.22%

San Diego +1.21%

Charlotte +1.18%

Dallas +1.17%

Portland +1.08%

Washington +0.93%

Miami +0.84%

Tampa 0.70%

Phoenix +0.56%

Phoenix has fallen from 19th to last place since last month. The national average increase month to month was 1.17%, so Phoenix under-performed significantly with less than half the increase shown by that benchmark.

Most areas had exceptionally strong rises, especially in the North and along the West Coast. Florida has faded.

Comparing year over year, we see the following changes:

San Diego +10.3%

New York +9.4%

Chicago +8.7%

Los Angeles +8.6%

Cleveland +8.5%

Las Vegas +8.3%

Miami +8.2%

Boston +7.9%

Seattle +7.5%

Charlotte +7.3%

Detroit +7.2%

Denver +6.4%

Atlanta +5.9%

Phoenix +4.8%

San Francisco +4.7%

Tampa +3.6%

Dallas +3.4%

Minneapolis +2.9%

Denver +2.0%

Portland +1.7%

Phoenix stayed at 14th place once again, and is still stuck in the bottom half on a year over year basis. All 20 of the cities are again showing positive price movement from one year ago with Denver and Portland once again at the bottom. Southern California and the North are in the lead.

The national average is +6.3% year over year. Phoenix is below that percentage, and in a similar situation to the last two months.

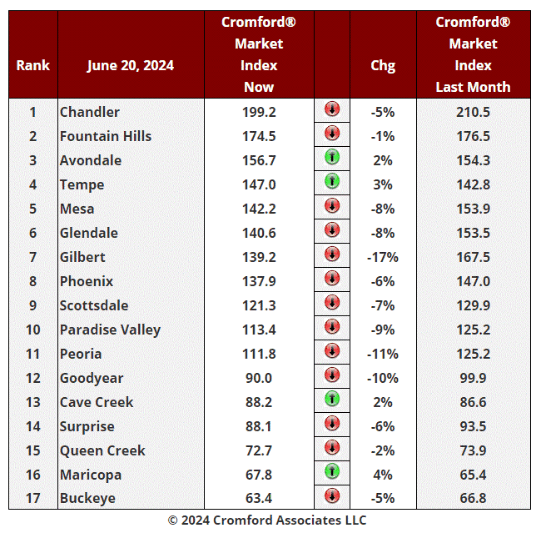

Jun 20 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -5.0%, a steeper fall than the -3.4% we saw last week . This is increasing the downward trend that started 5 weeks ago. Price reductions are still increasing in both size and frequency.

As last week, we only have 4 cities showing an increase in their Cromford® Market Index over the past month, while 13 have declined.

Maricopa is the biggest mover in favor of sellers but it is only up 4% over last month. Gilbert, Peoria, Goodyear, Paradise Valley, Mesa, and Glendale are the primary locations moving in favor of buyers, with Gilbert's market deteriorating the fastest..

Despite the continuing deterioration, 11 out of 17 cities remain seller's markets over 110. We have 1 city (Goodyear) that is barely balanced, while the remaining 5 are buyer's markets.

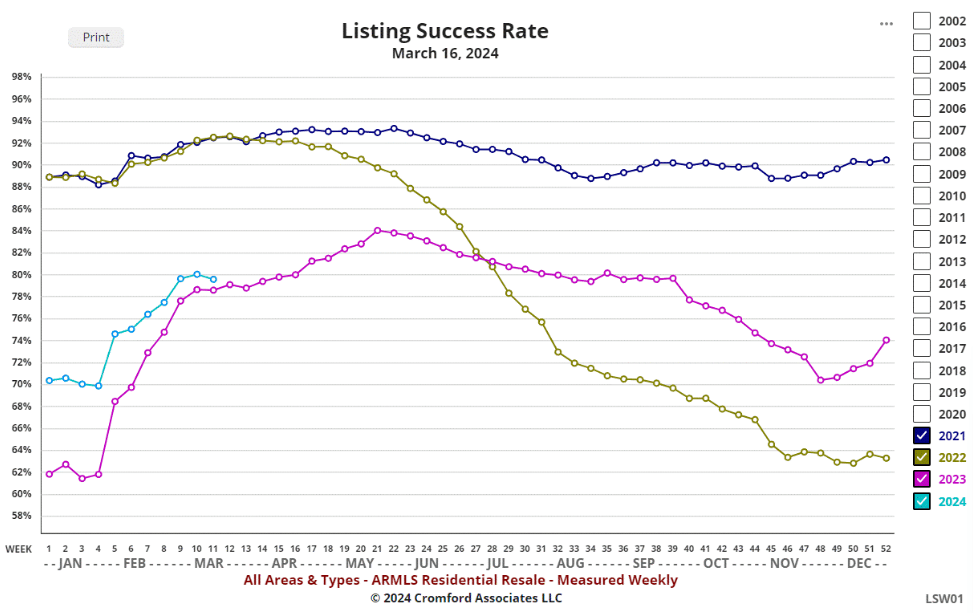

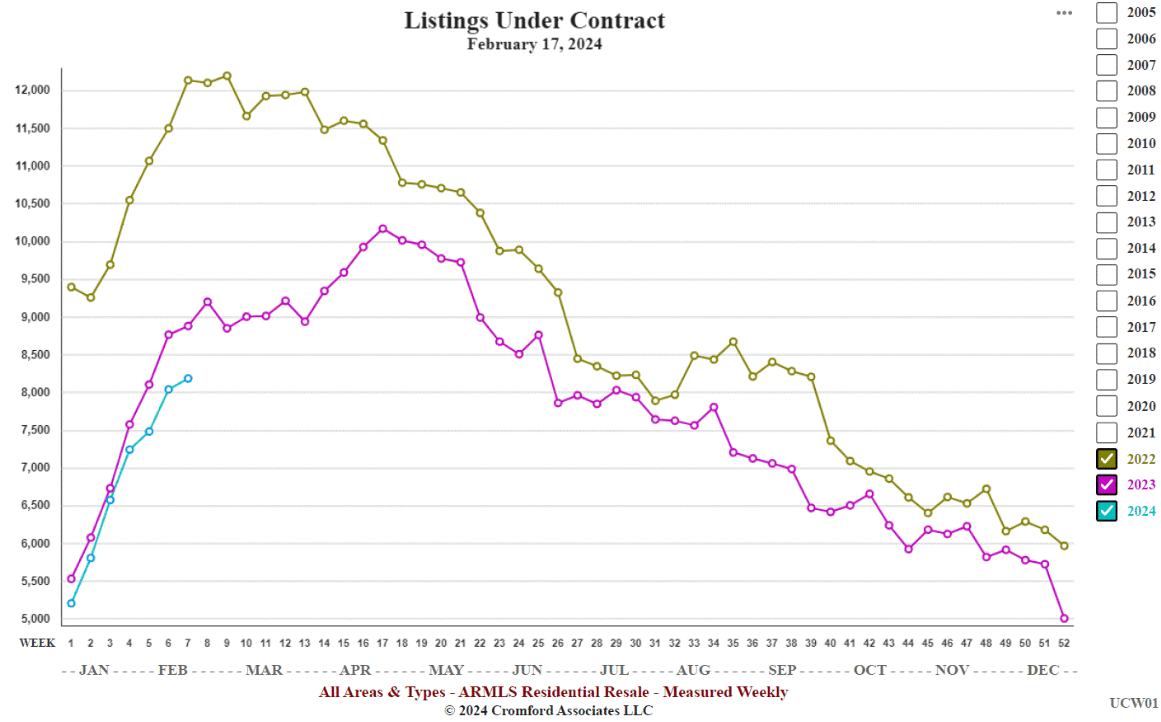

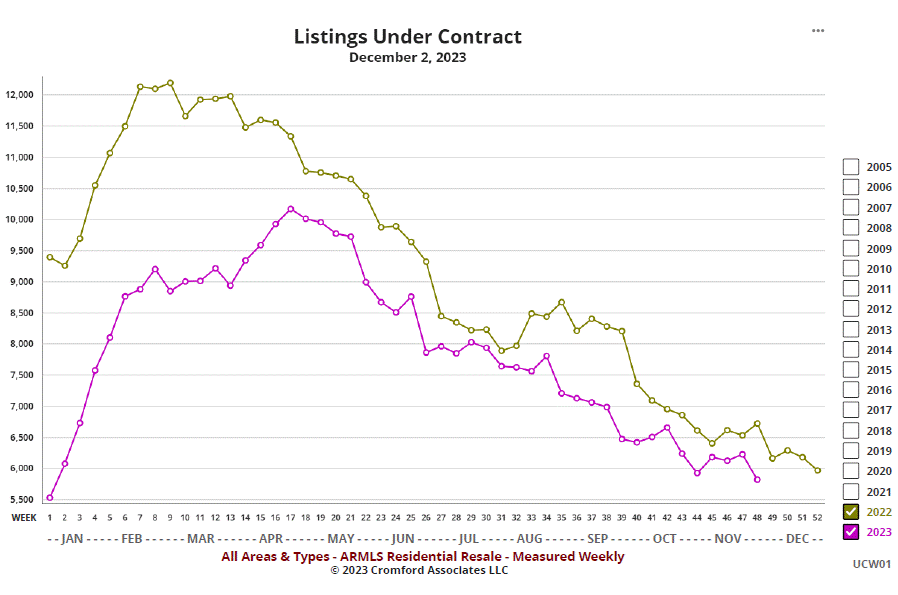

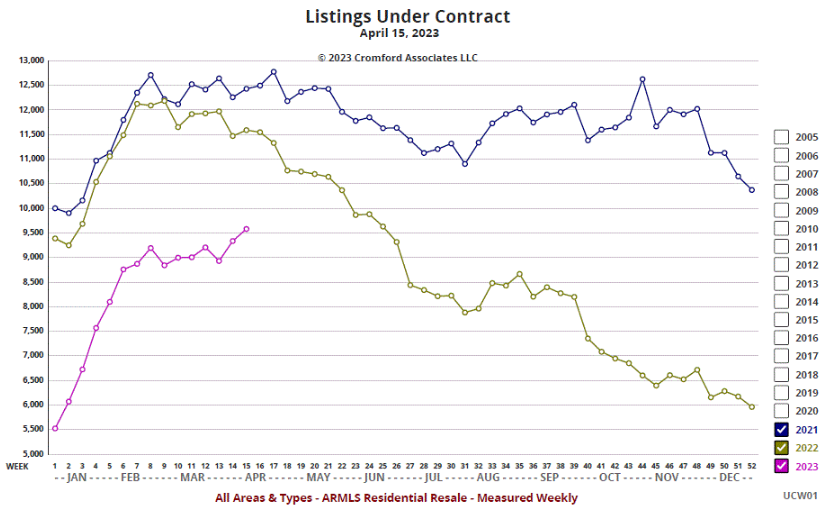

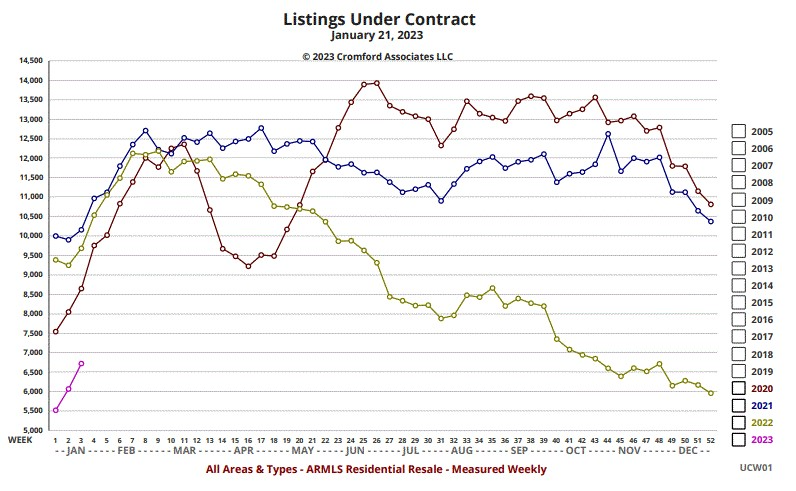

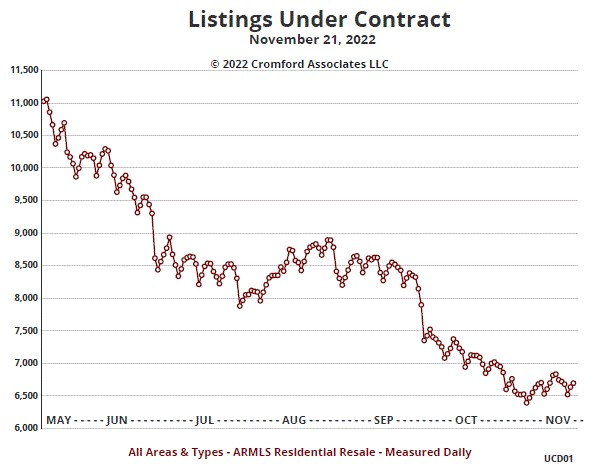

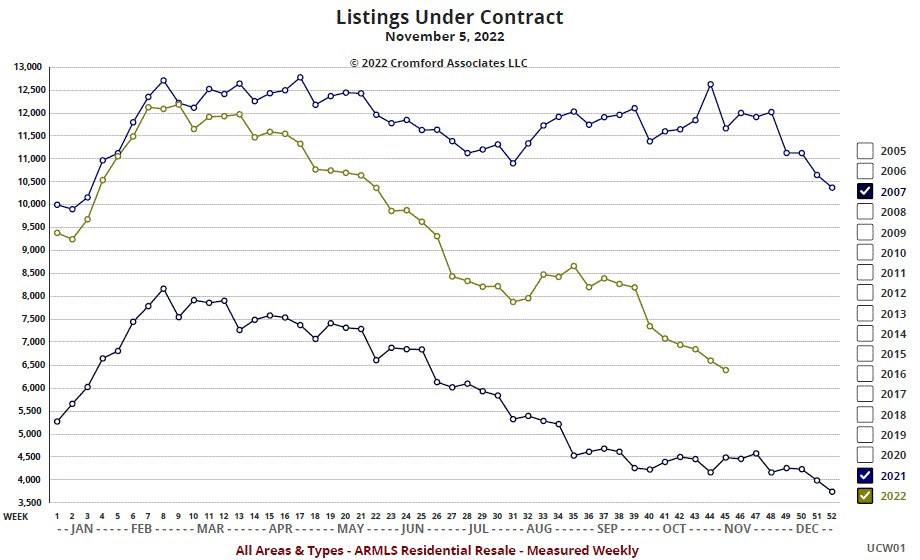

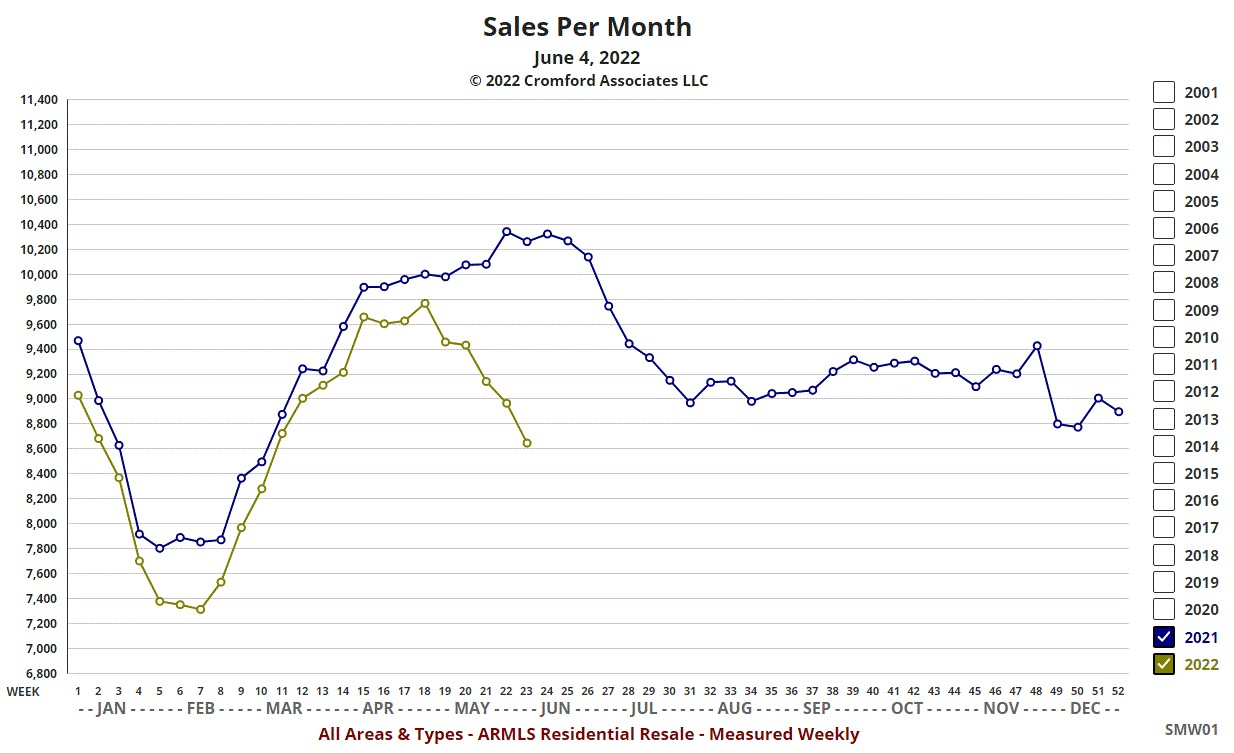

Jun 14 - The number of listings under contract (8,238) at week 23 is the lowest we have recorded for that time of the year since 2007.

At no point so far in 2024 has the count managed to claw its way above the miserable totals for 2023.

Now 2007 was an awful year with the market stalled by the certain knowledge that house prices were about to collapse. We are not in that situation in 2024, but buyer enthusiasm for re-sale homes is still very low indeed. To put 8,238 into perspective, the total for week 23 of 2011 was well over 21,000.

If the 30-year fixed mortgage rate finally tumbles well below 7% then things are likely to improve. I recommend watching the turquoise line above to see if it can creep above the purple line over the next couple of months.

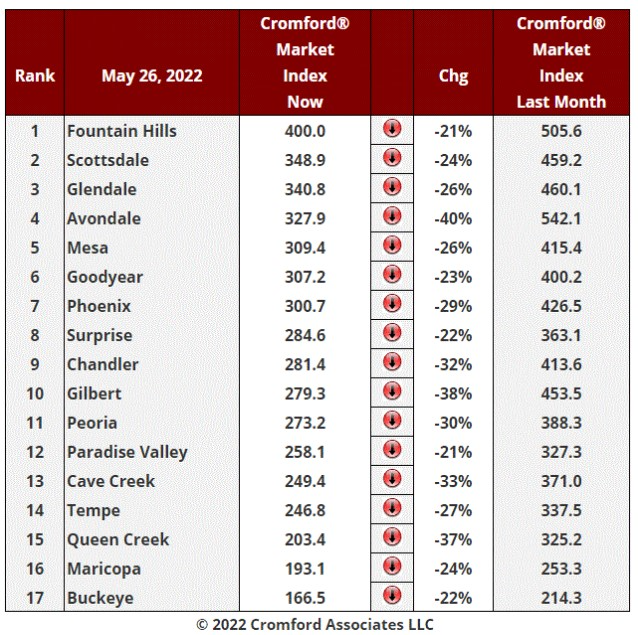

Jun 13 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -3.4%, a steeper fall than the -2.1% we saw last week . This is continuing the downward trend that started 4 weeks ago. Price reductions are again increasing in both size and frequency.

In contrast to last week, we only have 4 cities showing an increase in their Cromford® Market Index over the past month, while 13 have declined.

Cave Creek is the biggest mover in favor of sellers but it is only up 8% over last month. Glendale, Peoria, Mesa, Phoenix and Gilbert are the primary locations moving in favor of buyers, with Gilbert's market deteriorating the fastest..

Despite the continuing deterioration, 11 out of 17 cities remain seller's markets. We have 2 cities (Goodyear and Cave Creek) that are balanced, while the remaining 4 are buyer's markets.

Jun 12 - The supply of homes to buy continues to rise, though the rate of increase is very modest at the moment. The supply of homes to rent is on a steeper upward trajectory. Yesterday we had 4.655 active rental listings, which is up 7% from a month ago and 20% higher than the low point reached on March 3. It is also up 14% than on June 11 last year.

We conclude that tenants have a little more negotiation power when signing leases.

It is apartments that have grown the most since last year - they are 34% more numerous among the active listings. Single-family rental units have increased much less - only 9%. Townhouses are in between with 15% more than a year ago,

Jun 10 - The median sales price is very little affected by the luxury market because luxury homes sell in relatively small numbers. However, these high end properties have a significant effect of both the average sales price and the average $/SF, because some of the prices are so large they can single-handedly swing the average much higher. The median tends to ignore all of the extremes at the top and bottom. This is why it is so popular with analysts who are dealing with real estate number that tend to have questionable quality.

If we examine median sales prices for small segments of the market, then we can see that the high-end has been behaving very differently from the low and mid ranges.

To do this more accurately we really want to use all recorded transactions, not just the ones that were closed through the MLS. So we turn to the Cromford® Public chart EM11 and use the various filters to find that:

the overall median sales price has been in a rising trend since February 2023 but has still not overtaken the peak of $470,000 achieved in both May and June of 2022. It stood at $456,995 as of April 2024.

if we restrict our study to the Northeast Valley (Scottsdale, PV, Fountain Hills, Cave Creek and Carefree), then the median is strong and hit a new record high of $879,500 in April 2024. The low point was January 2023 at $730,000

looking at the fringes of the valley represented by Buckeye, Maricopa, and San Tan Valley, then the median sales price is only marginally higher at $410,00 from where it landed at the low point in February 2023. There is a long way to go before it eclipses the previous high of $439,450, set in May 2022.

Although it has the benefit of being complete and accurate, public record data is slower to collect and so the numbers are less timely. This is why we refer to April numbers rather than May.

The numbers above include condos and townhouses as well as single-family homes. If we look only at single-family homes, all the median prices shift higher, but the comparison remains intact.

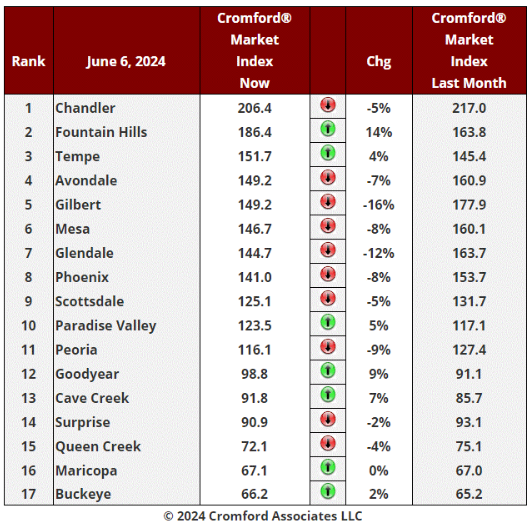

Jun 6 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -2.1%, down from -0.8% last week and continuing the downward trend that started 3 weeks ago. The market is deteriorating a little faster now for sellers. Price reductions are increasing in both size and frequency.

On a brighter note, we now have 7 cities showing an increase in their Cromford® Market Index over the past month, while 10 have declined.

Fountain Hills is easily the biggest movers in favor of sellers. Glendale and Gilbert are once again the primary locations moving in favor of buyers.

Despite the continuing deterioration, 11 out of 17 cities are still seller's markets. We have 3 cities (Goodyear, Cave Creek and Surprise) that are balanced, while the remaining 3 are buyer's markets.

Buckeye and Maricopa swapped places at the bottom of the table. Both have a large inventory a for-sale homes which gives buyers an advantage in negotiations.

Jun 5 - The affidavits of value have been counted and analyzed for Maricopa County's April filings and here is what we found:

There were 7,858 closed transactions, down 5% from 8,255 in May 2023 but up 8% from April.

There were 1,572 closed new homes, down 12% from 1,788 in May 2023 but up 10% from April.

There were 6,286 closed re-sale transactions, down 3% from 6,467 in May 2023 but up 8% from April.

The overall median sales price in May was $475,000, up 2.5% from May 2023 but down 0.3% from April.

The re-sale median sales price was $460,000, up 2.7% from May 2023 but down 1.1% from April.

The new home median sales price was $520,634, up 2.7% from May 2023 and up 1.0% from April.

Closing counts look good when compared with last month, but are down compared with a year ago. New homes closings were noticeably weaker, falling 12% compared to a year ago, suggesting demand for new homes may be losing steam after a very good run..

New home market share peaked at almost 28% in December 2023 and has been falling back towards more normal levels. It stood at 20% in May.

Prices were slightly weaker in May than they had been in April, back down to the level of March. We see an annual gain in the median of around 2.5%, which is lower than the overall inflation rate.

These numbers are for single family and townhouse / condo homes.

Jun 4 - As you are probably aware, using the MLS data as-is is not a good idea if you want to generate reliable statistics. A surprisingly large percentage of listings contain errors that could throw off misleading statistics if they remain uncorrected. A few examples include:

wrong County - most common is agents who think Maricopa City is in Maricopa County instead of Pinal. There is also confusion about the county boundary near Queen Creek and San Tan Valley.

typo in the price - e.g. repeated digits or omitted digits

bad dates - closed date may be before contract date or even the listing date. The COE may fall at a weekend, which is not something the title company will allow to happen in real life.

wrong ZIP code - happens much more than you might think - we use the USPS to confirm the correct ZIP code for each parcel

wrong dwelling type - doesn't match the actual property

etc. etc.

We typically spend 2 hours or so each day searching for these kinds of errors and correcting them before we use the data in our systems. Doing this yourself is not recommended, it is soul destroying work. Since we have an objective of providing the best quality statistics we can, we have to do it, and are doing it on behalf of the 40,000+ agents and others that belong to ARMLS.

Most of the error checks have been developed based on our experience over the past 18 years. Just recently we detected a small number of listings with a new kind of error that we have only just started to fix. Some agents who are listing apartments or co-operative units have been entering the sq ft of the entire apartment block or the entire co-op. This means we are calculating the price per sq. ft. with too many sq. ft. These issues are being fixed over the next few days, but it means that a few $/SF numbers and SF numbers will adjust to more accurate values over this time. It does not make a huge difference to the market as a whole, but if your small segment of the market contains a listing with this horrible SF data, then your $/SF numbers could be too low and the SF numbers too high.

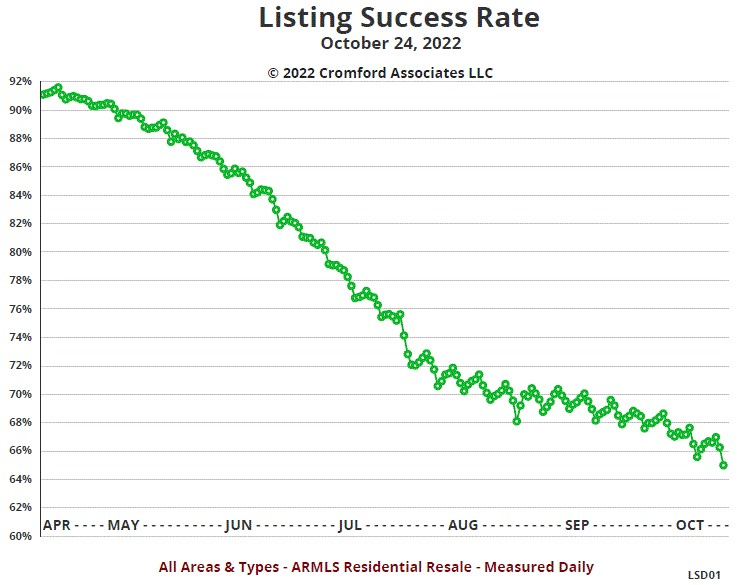

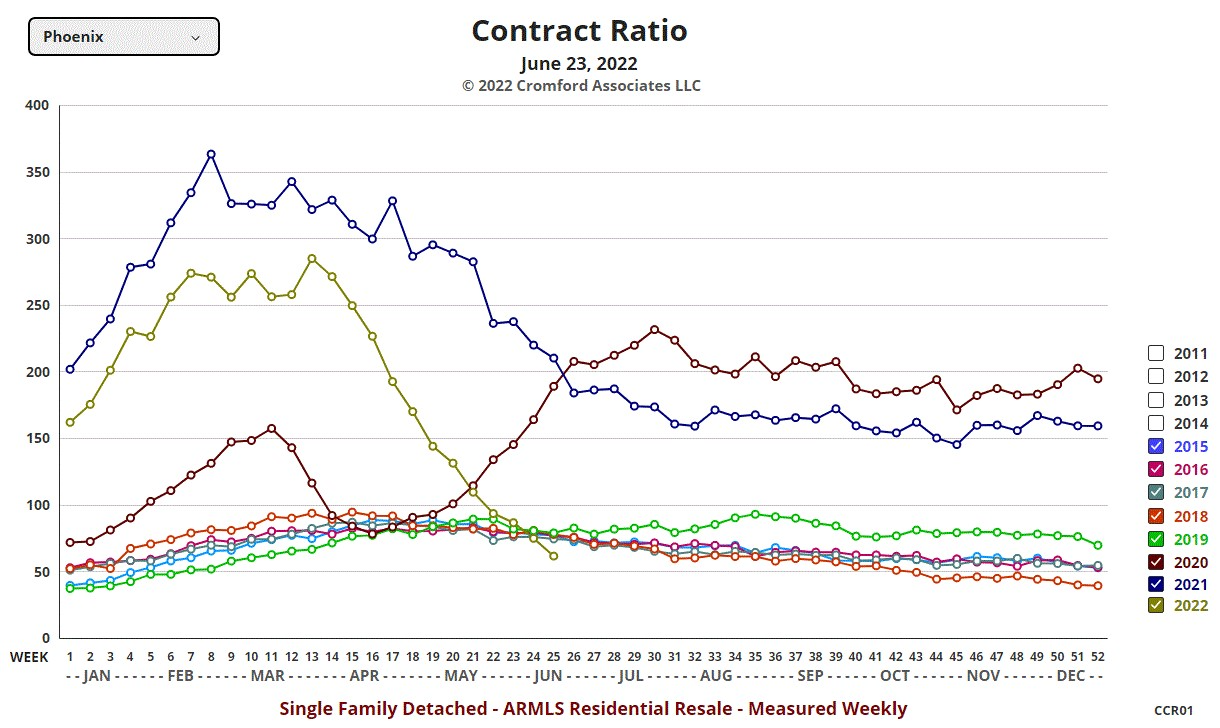

Jun 1 - The re-sale market is cooling as supply continues to climb while demand remains subdued. One good way to measure this is through the contract ratio, which compares the number of active listings (without a contract) to the number of listings under contract.

For all areas & types, the contract ratio has dropped 15% from 54.5 to 46.1 over the last month. This compares poorly with 77.0 on June 1 last year. The current 46.1 reading represents a balanced market with buyers finding plenty of supply to choose from and sellers experiencing more competition from each other than they have for most of the last decade. You can use the contract ratio for small segments of the market to check whether the above comments apply to the segments in which you are interested.

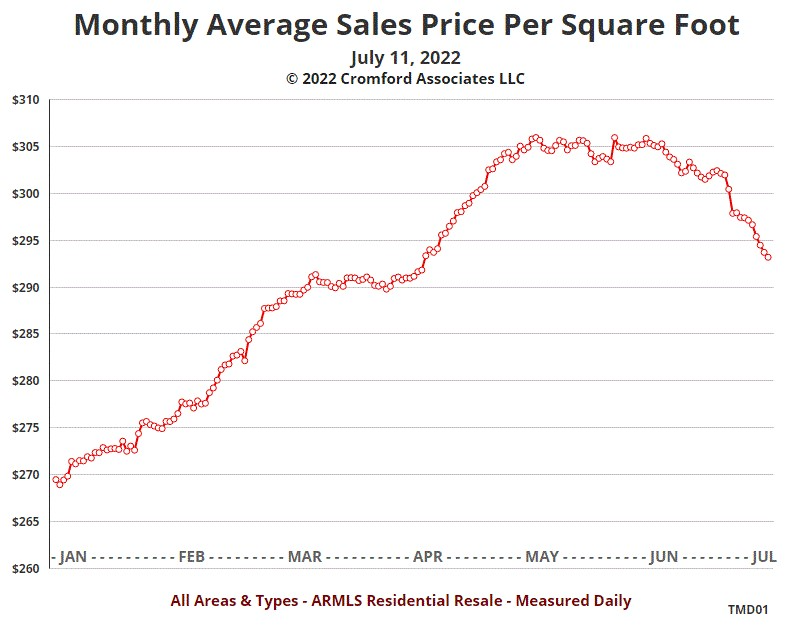

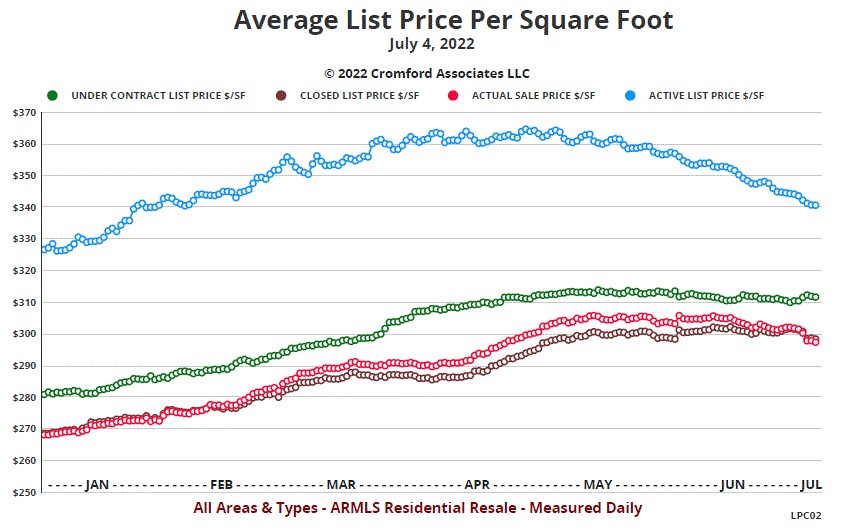

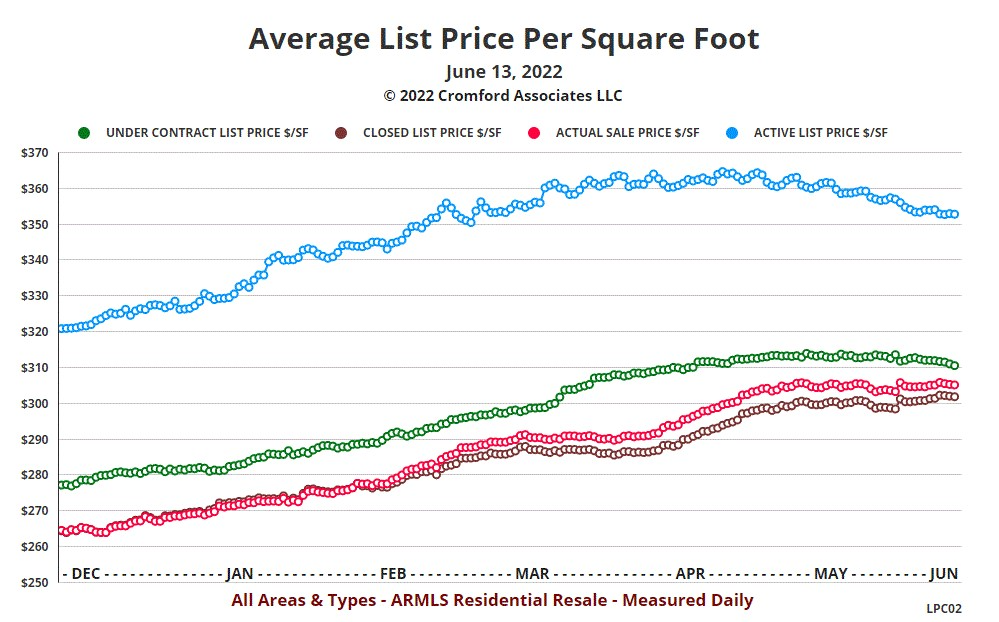

Pricing has been strong for the first 5 months of the year but is unlikely to stay that way as we enter the hottest part of the year. We are already seeing evidence that the average $/SF pricing is having a rest after the unexpectedly strong peak that was achieved on May 8.

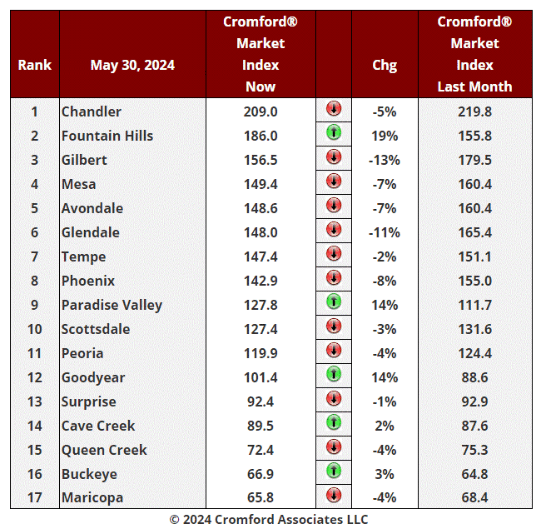

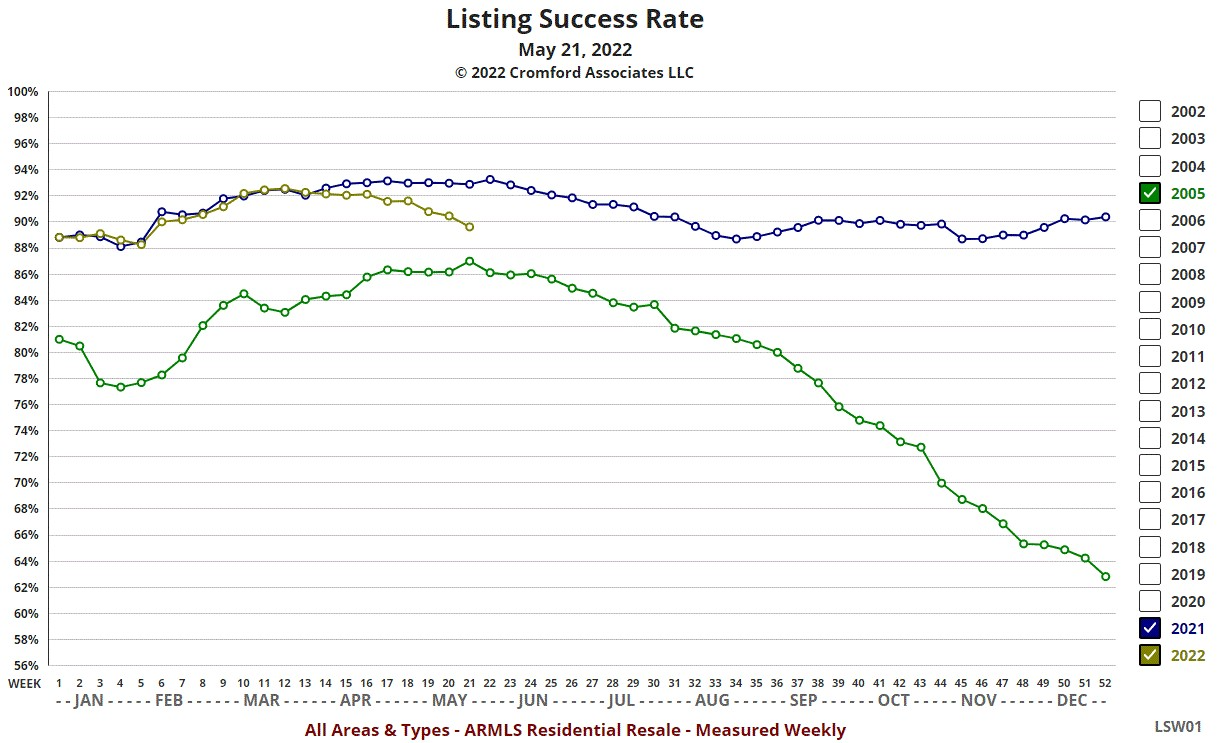

May 30 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is -0.8%, down from +0.1% last week and continuing the downward trend that started 2 weeks ago. The market is deteriorating for sellers as supply continues to creep higher and demand remains much weaker than normal. We expect more impatient sellers to increase the size and frequency of price reductions.

We have only 5 cities showing an increase in their Cromford® Market Index over the past month, while 12 have declined. This is the same as last week.

Paradise Valley, Fountain Hills and Goodyear are by far the biggest movers in favor of sellers. Glendale and Gilbert are the primary locations moving in favor of buyers.

Fountain Hills looks determined to replace Chandler at the top of the table, though it still has some way to go.

Despite the deterioration, 11 out of 17 cities are seller's markets. We have 2 cities (Goodyear and Surprise) that are balanced, while the remaining 4 are buyer's markets.

May 28 - The latest S&P / Case-Shiller® Home Price Index® numbers were published this Tuesday.

The new report covers home sales during the period January to March 2024. This means the typical home sale closed in mid February, more than 3 months ago. Please remember that Case-Shiller data is fairly old, even on the day it is released.

A big turn-around has taken place in the last 2 months. We have all 20 cities showing rising prices for last month. The Pacific coast had another remarkably strong month.

Comparing with the previous month's series we see the following changes:

Seattle +2.70%

San Francisco +2.59%

Cleveland +2.40%

San Diego +2.23%

Boston +1.88%

Los Angeles +1.70%

Chicago +1.66%

New York +1.50%

Portland +1.47%

Minneapolis +1.34%

Denver +1.33%

Washington +1.27%

Dallas +1.19%

Atlanta +1.15%

Detroit +1.14%

Miami +0.96%

Charlotte +0.96%

Las Vegas +0.92%

Phoenix +0.53%

Tampa +0.50%

Phoenix has fallen from 14th to 19th place since last month. The national average increase month to month was 1.29%, so Phoenix under-performed significantly against that benchmark.

Comparing year over year, we see the following changes:

San Diego +11.1%

New York +9.2%

Cleveland +8.8%

Los Angeles +8.8%

Boston +8.7%

Chicago +8.7%

Miami +8.2%

Seattle +7.8%

Detroit +7.7%

Las Vegas +7.7%

Charlotte +7.5%

Washington +7.0%

Atlanta +6.1%

Phoenix +4.9%

San Francisco +4.9%

Tampa +3.8%

Dallas +3.6%

Minneapolis +3.3%

Portland +2.2%

Denver +2.1%

Phoenix stayed at 14th place, and is therefore still in the bottom half on a year over year basis. All 20 of the cities are again showing positive price movement from one year ago with Denver and Portland at the bottom. Southern California and the North are in the lead.

The national average is +6.5% year over year. Phoenix is below that percentage, and in a similar situation to last month

May 27 - The typical 30-year fixed mortgage rate has been varying between 7% and 7.25% since May 6, which is better for buyers than the 7.25% to 7.5% range that we saw between April 11 and May 6.

Despite the better rates, demand has stayed weak and even weakened a little further. The number of listings under contract across all types and areas within the ARMLS database is 8,779. This is down 7% from the 9,441 we saw on April 27. It is also down almost 10% from this time last year.

As we approach the hottest months of the year, when demand tends to fall anyway, this weakness is not encouraging. Supply continues to rise, although slowly and the current trends are suggesting continued deterioration for sellers. It would not be a surprise if demand were to fall enough to match the supply of active listings over the next several weeks.

May 23 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is +0.1%, down from +0.8 last week and continuing the downward trend that started last week.

We have only 5 cities showing an increase in their Cromford® Market Index over the past month, while 12 have declined. This is also less positive than last week.

Paradise Valley, Fountain Hills and Goodyear are the biggest movers in favor of sellers. Tempe, Glendale, Gilbert and Maricopa are the primary locations moving in favor of buyers.

Now that Chandler is losing steam, Fountain Hills has a chance to replace it at the top of the table.

11 out of 17 cities are seller's markets. We have 2 cities (Goodyear and Surprise) that are balanced, while 4 are buyer's markets.

May 16 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is +0.8%, down from +1.8 last week and reversing the trend that started six weeks ago.

We have only 6 cities showing an increase in their Cromford® Market Index over the past month, while 11 have declined. This is significantly less positive than last week.

Paradise Valley, Peoria, Fountain Hills and Goodyear are the biggest moves in favor of sellers. Tempe, Queen Creek and Maricopa are the primary locations moving in favor of buyers. Buckeye has been improving for sellers and is no longer at the bottom of the table having been replaced by Maricopa is looking very likely to take its place. Chandler is still far out in front at the top, but Fountain Hills is now the main challenger.

11 out of 17 cities are seller's markets. We have 2 cities (Goodyear and Surprise) that are balanced, while 4 are buyer's markets.

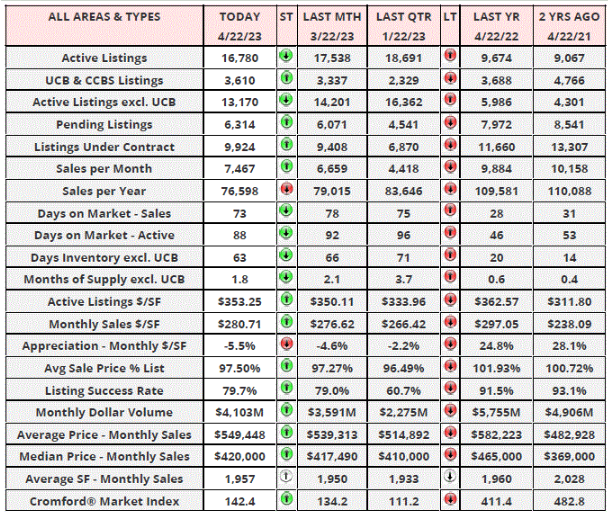

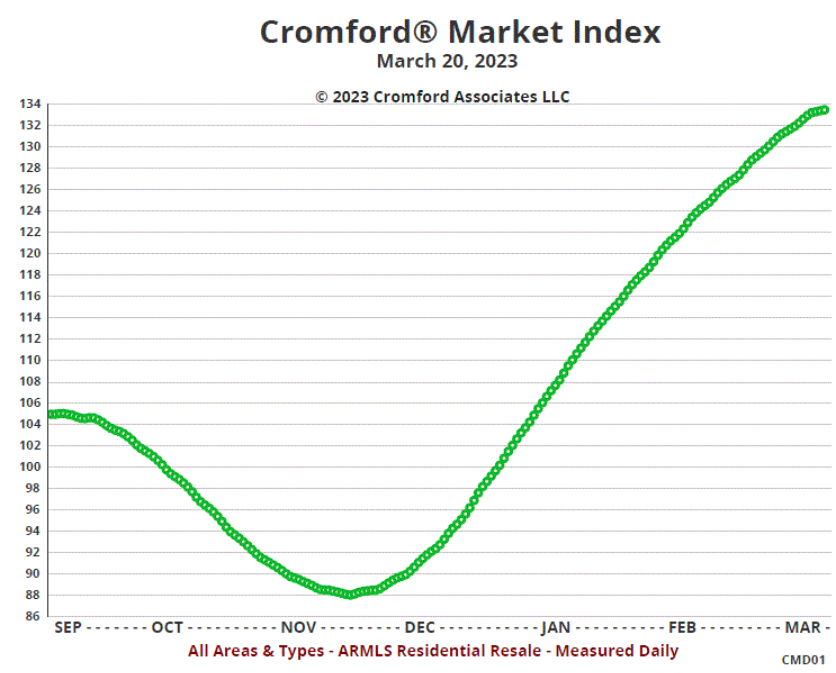

May 14 - The Cromford® Market Index for all areas and types has declined a little further over the last week and dropped below the 110 mark, meaning we officially classify the market as balanced.

The decline has been very slow so there is no likelihood of anyone feeling the difference from one week to the next. However supply keeps creeping higher and demand remains very weak.

There is also a big difference between areas like Chandler and Gilbert which remain under firm control by sellers and areas like Maricopa and Buckeye where buyers have a strong advantage due to the plentiful supply, which includes a large number of newly built homes.

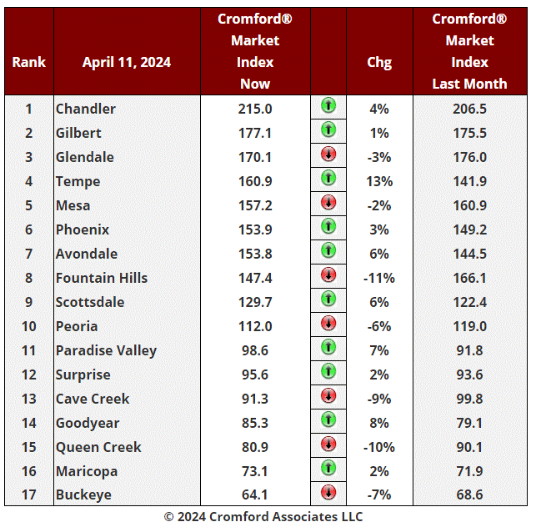

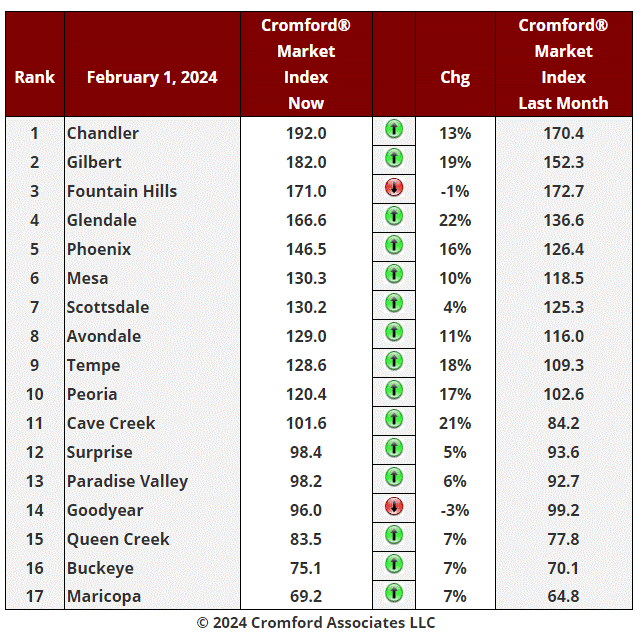

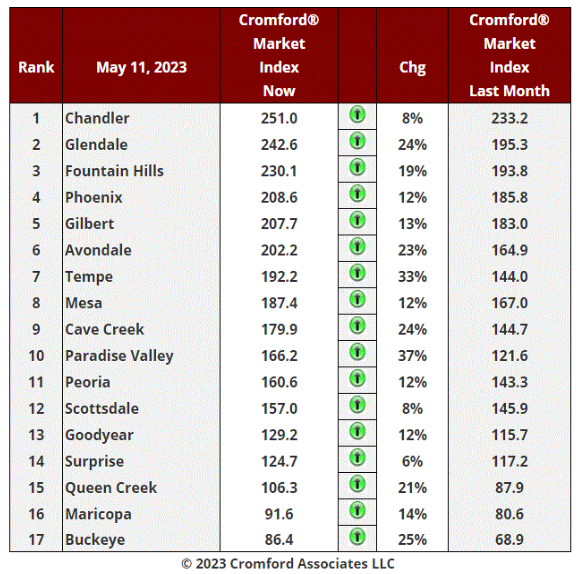

May 9 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

Once again we are seeing small signs of improvement in the market for sellers in certain sub-markets.

The average change in CMI over the past month is +1.8%, up from +1.7 last week and continuing a mild trend that started five weeks ago.

We have 10 cities showing an increase in their Cromford® Market Index over the past month, while 7 have declined. This is less positive than last week.

Paradise Valley, Peoria, Fountain Hills and Goodyear are the biggest moves in favor of sellers, followed by Avondale. Tempe, Queen Creek, Maricopa and Cave Creek are the primary locations moving in favor of buyers. Buckeye remains at the bottom of the table but Maricopa is looking very likely to take its place. Chandler is still far out in front at the top.

11 out of 17 cities are seller's markets now that Paradise Valley has joined the group. We have 2 cities (Goodyear and Surprise) that are balanced, while 4 are buyer's markets.

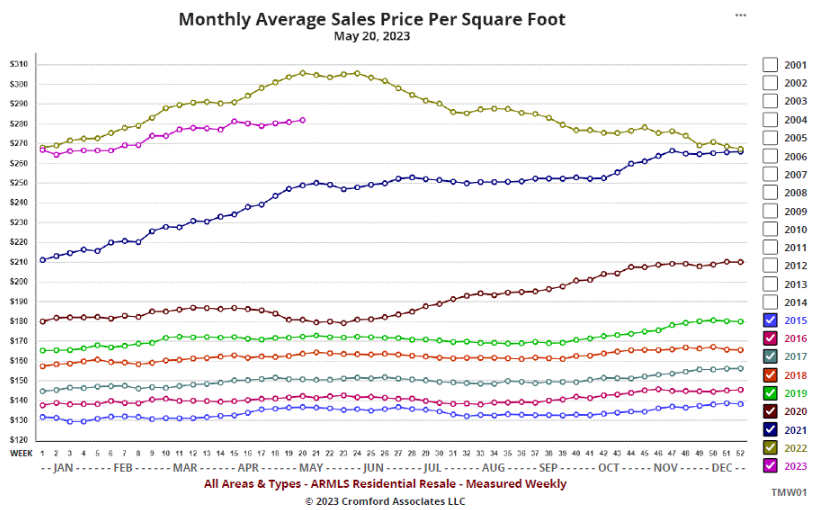

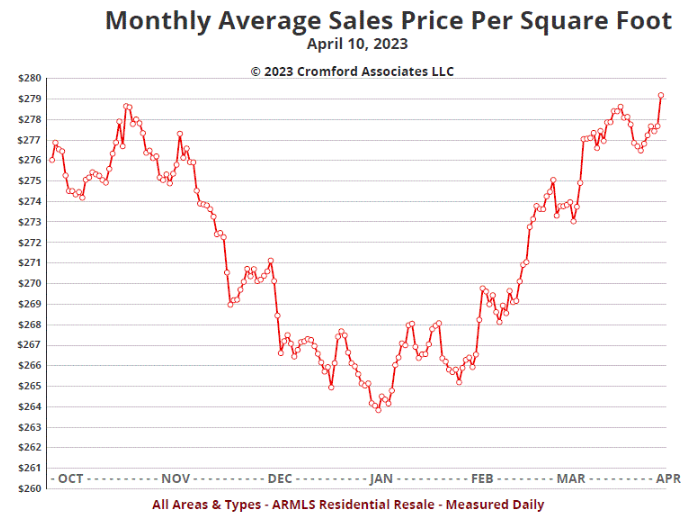

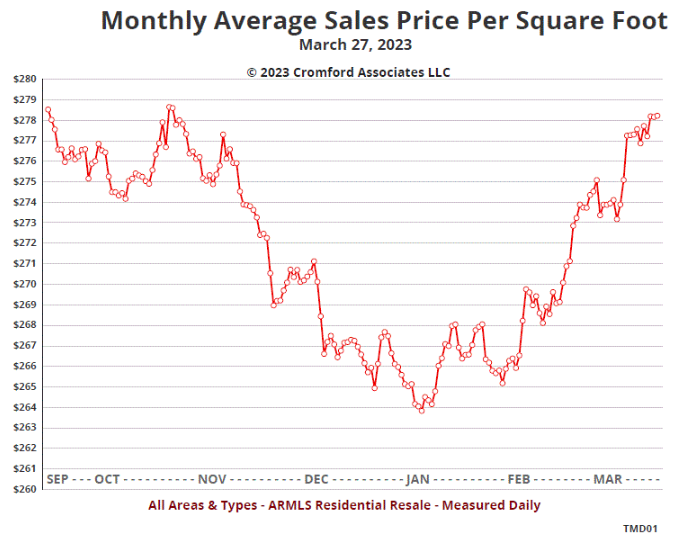

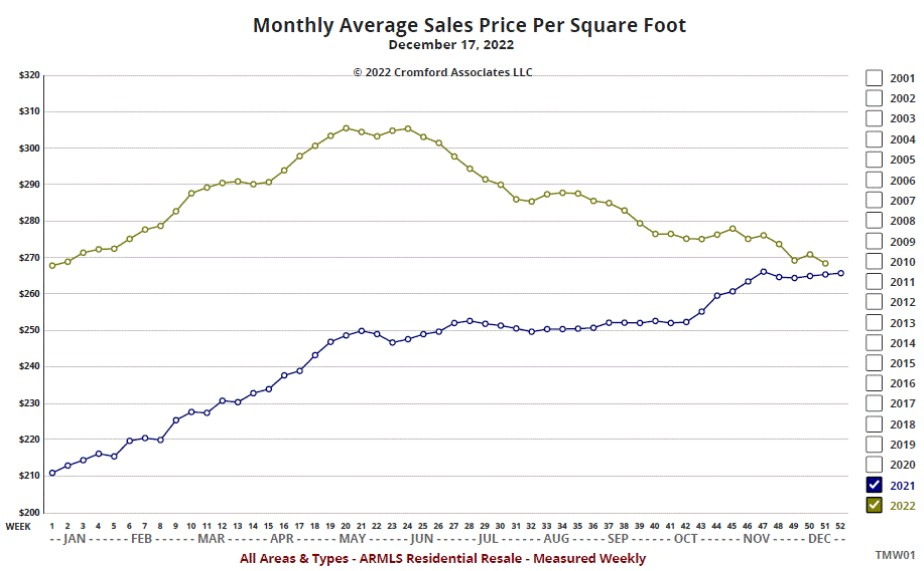

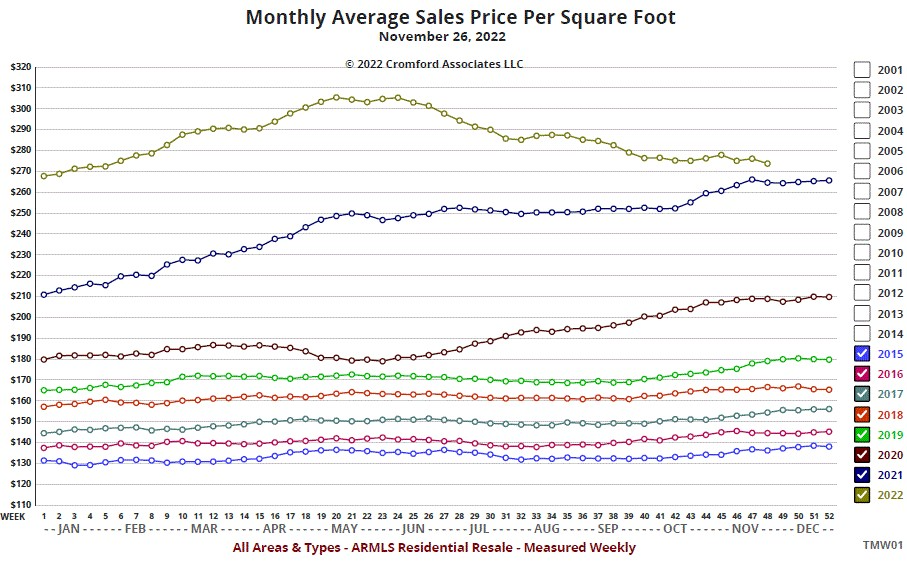

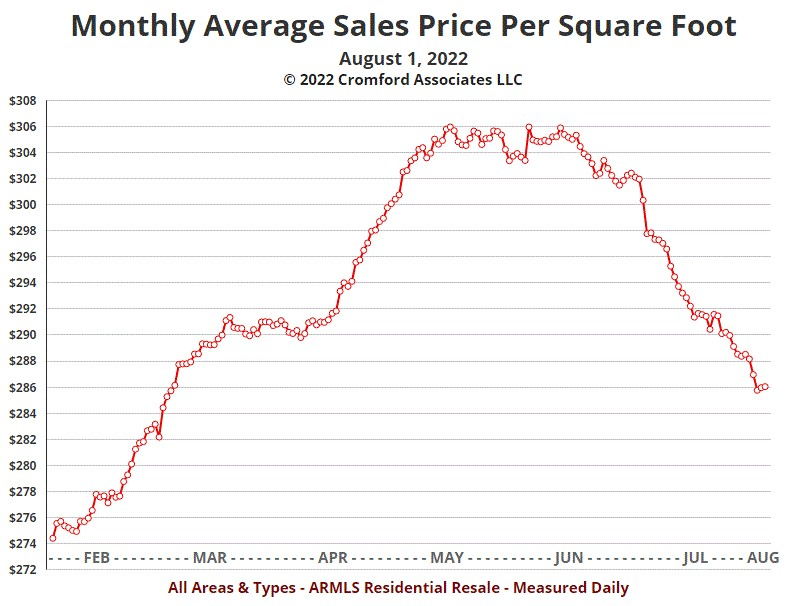

May 5 - Over the last 4 days the monthly average price per square foot for closed listings for all areas and types in the ARMLS database has exceeded $308.

This means it has made a new all-time record high - $308.01.

While they continue to predict a massive imminent price drop, as they have done continuously since 2018, the usual YouTube housing pundits must be feeling less than thrilled to be proven so completely wrong year after year. However they remain undaunted. Their predictions have little to no substance behind them and I notice a lack of confidence creeping into their voices. Bad news attracts clicks is something they do understand.

Again and again, they make the mistake of thinking a weakening of demand will force prices down. The market sees low volumes when demand is weak, but to get prices to come down you need excess supply and desperate sellers.

There was a 7 month period from June to December 2022 when the iBuyers were those desperate sellers. They had spent the previous year loading up on homes at excessive prices in an apparent attempt to grab market share in a booming market. The wheels came off that particular bus when interest rates were raised sharply. Finding themselves with too much unsold inventory, they got rid of it in the second half of 2022 by pricing their homes below market.

Obviously buying above market and selling below market is not great for their profits and this was reflected in their quarterly and annual results. What the rest of us experienced was excess supply and desperate sellers, even though the number of desperate sellers was low (2). Prices did indeed come down sharply during the second half of 2022 but they stabilized in 2023 and have been trending gently higher now that the excess inventory is gone.

I expect the usual seasonal decline in average $/SF during the 3Q, but for now, the market deserves some respect for its resilience and sellers can celebrate the new all-time high.

May 4 - The affidavits of value have been counted and analyzed for Maricopa County's April filings and here is what we found:

There were 7,248 closed transactions, up 6% from 6,840 in April 2023 and up 5% from March.

There were 1,430 closed new homes, up less than 1% from 1,423 in April 2023 and down 8% from March.

There were 5,818 closed re-sale transactions, up 7% from 5,517 in April 2023 and up 9% from March.

The overall median sales price in April was $476,545, up 4.7% from April 2023 and up 0.3% from March.

The re-sale median sales price was $465,000, up 6.9% from April 2023 and up 1.3% from March.

The new home median sales price was $515,279, up 0.4% from April 2023 and also up 0.4% from March.

Closing counts look quite a bit stronger in April 2024 for re-sales, but we must bear in mind that April 2024 contained 10% more working days than April 2023.

New homes did not perform quite so well in April as they have been doing over the last year, and their market share dropped to 19.7%, their lowest percentage since July 2022.

These numbers are for single family and townhouse / condo homes.

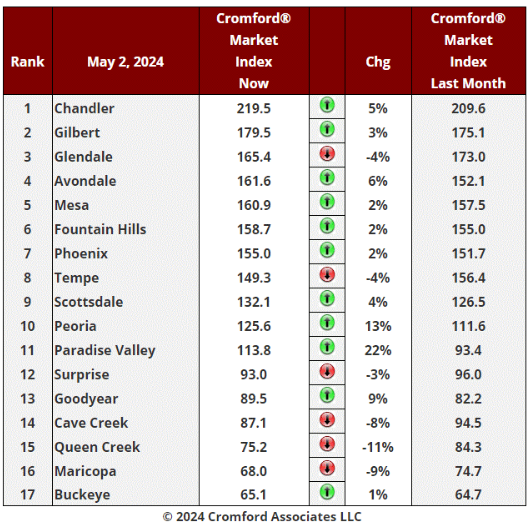

May 2 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

Once again we are seeing small signs of improvement in the market for sellers in certain sub-markets.

The average change in CMI over the past month is +1.7%, up from +1.4% last week and continuing a trend that started four weeks ago.

We have 11 cities showing an increase in their Cromford® Market Index over the past month, while 6 have declined. This is also better than last week.

Paradise Valley, Peoria and Goodyear are the biggest moves in favor of sellers, followed by Avondale and Chandler. Queen Creek, Maricopa and Cave Creek are the primary locations moving in favor of buyers. Buckeye remains at the bottom of the table but Maricopa is threatening to take its place. Chandler is still far out in front at the top. Queen Creek is now well below 80 while Maricopa has joined Buckeye below the 70 level. Buyers have strong negotiating power at these three locations.

11 out of 17 cities are seller's markets now that Paradise Valley has joined the group. We have 1 city (Surprise) that is balanced, while 5 are buyer's markets, although Goodyear looks set to leave that group very shortly.

Apr 30 - The latest S&P / Case-Shiller® Home Price Index® numbers were published this Tuesday.

The new report covers home sales during the period December 2023 to February 2024. This means the typical home sale closed in mid January, more than 3 months ago. Please remember that Case-Shiller data is fairly old, even on the day it is released.

A big turn-around has taken place since last month. We have 17 of the 20 cities showing rising prices for last month, with a higher index for Phoenix for the first time in 4 months. Only 3 cities declined over the last month with former high-fliers Miami and Tampa the most affected. The Pacific coast had a remarkably strong month.

Comparing with the previous month's series we see the following changes:

Seattle +2.27%

San Diego +1.69%

San Francisco +1.66%

Portland +1.17%

Washington +1.12%

Los Angeles +1.06%

Chicago +1.05%

Boston +0.99%

Denver +0.86%

New York +0.76%

Minneapolis +0.74%

Las Vegas +0.64%

Dallas +0.58%

Phoenix +0.45%

Detroit +0.45%

Atlanta +0.43%

Charlotte +0.20%

Cleveland -0.01%

Miami +0.09%

Tampa -0.32%

Phoenix has risen from 16th to 14th place since last month. The national average increase month to month was 0.59%, so Phoenix under-performed against that benchmark.

Comparing year over year, we see the following changes:

San Diego +11.4%

Chicago +9.0%

Detroit +8.9%

Los Angeles +8.7%

New York +8.7%

Charlotte +8.2%

Boston +8.0%

Miami +8.0%

Las Vegas +7.3%

Washington +7.1%

Seattle +7.1%

Cleveland +7.0%

Atlanta +6.4%

San Francisco +5.2%

Phoenix +4.9%

Tampa +4.3%

Minneapolis +3.9%

Dallas +3.5%

Denver +2.8%

Portland +2.2%

Phoenix slipped from 14th to15th place, and is still in the bottom half on a year over year basis. All 20 of the cities are now showing positive price movement from one year ago with Portland once again at the bottom. Southern California and the North are in the lead.

The national average is +6.4% year over year. Phoenix is below that percentage, and more so than last month.

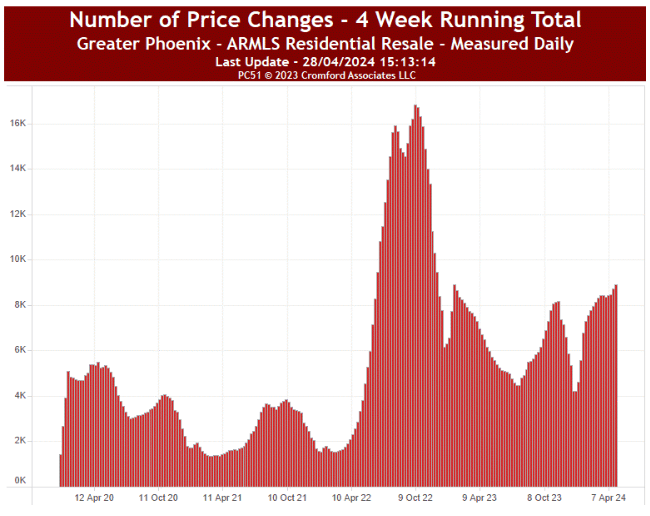

Apr 28 - We are seeing almost 9,000 price cuts over the last 4 weeks, a level we have not seen since January last year.

Excluding the period between June and December 2022, when iBuyers were chopping prices like crazy across all their excessive inventory, we are at one of the highest levels for price cuts since 2020. Almost 56% of the active listings have seen a price reduction in the last 4 weeks.

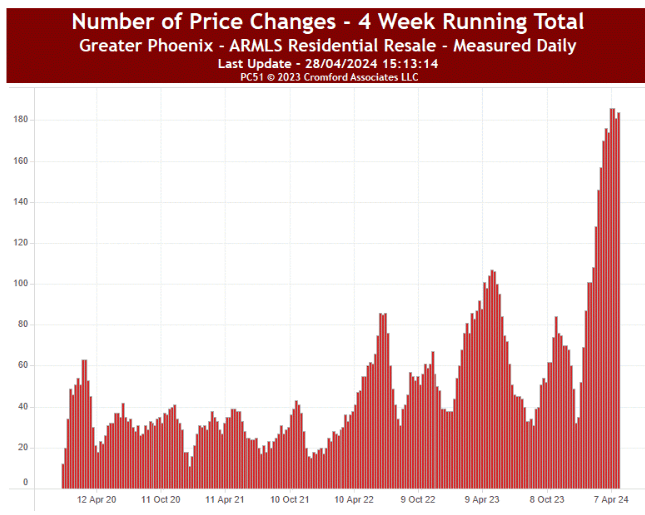

Although their listings are far less numerous, homes over $3 million are also seeing far more price cuts than usual, as seen in the chart below:

They tend to stay on market for a much longer time and their price reductions are usually spread out over many months.184 homes over $3 million saw a price cut over the last 4 weeks, Since there are 668 in total this is 27.5% of the high-end listings getting reduced. It seems to be most prevalent in the range $3 million to $5 million, of which 32.4% have seen a price cut in the last 4 weeks. A smaller percentage of homes over $5 million have been reduced - 22%.

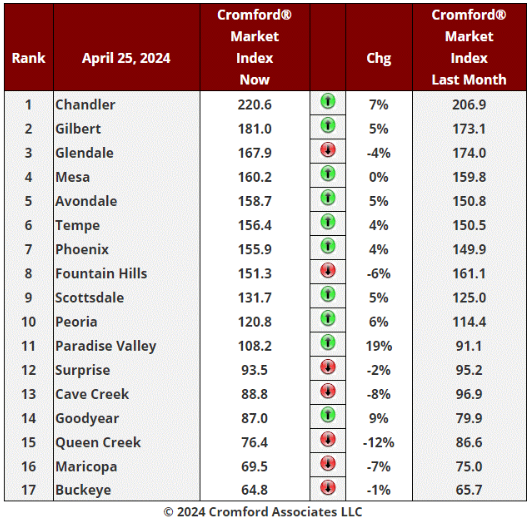

Apr 25 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

We are starting to see few signs of improvement in the market for sellers, at least in certain sub-markets.

The average change in CMI over the past month is +1.4%, up from +1.1% last week and continuing a trend that started three weeks ago.

We have 10 cities showing an increase in their Cromford® Market Index over the past month, while 7 have declined. This is also better than last week.

Goodyear and Paradise Valley are the biggest moves in favor of sellers, followed by Chandler. Queen Creek, Cave Creek and Maricopa are the primary locations moving in favor of buyers. Buckeye remains adrift at the bottom of the table while Chandler is still way out in front at the top. Queen Creek is now well below 80 while Maricopa has joined Buckeye below the 70 level. Buyers have strong negotiating power at these three locations.

10 out of 17 cities are seller's markets. We have 2 cities that are balanced, while 5 are buyer's markets. Paradise Valley looks set to become a seller's market by next week.

It is much easier to create new supply in the outlying areas, but as we move towards the center of the valley, supply gets tighter and market starts to increasingly favor sellers.

Apr 24 - Single-family building permits are still running far ahead of last year and the total of 8,334 for the first quarter of 2024 across Maricopa and Pinal was the highest quarterly number since Q1 2022.

The top 10 locations for new permits during the first quarter of 2024 were:

1. Phoenix (1,250)

2. Surprise (1,005)

3. Unincorporated Pinal County (993)

4. Unincorporated Maricopa County (669)

5. Buckeye (583)

6. Peoria (572)

7. Queen Creek (540)

8. Goodyear (540)

9. Maricopa (333)

10. Mesa (291)

Peoria showed the largest growth over last year, when there were only 54.

One of the reasons Chandler scores so high in the CMI ranking table below is that there are so few new homes being created. Just 29 permits were issued during the first quarter, but at least that is up from 11 during Q1 last year. Gilbert only gave us 72, down from 123 in 2023 and Tempe saw only 25.

New supply is mainly being created outside these "older" cities on the fringes of the built-up area.

Apr 21 - The average price per square foot for all areas & types has breached the $300 level again.

The record stands at $306.39, set on June 10, 2022. This was followed by a 14% correction down to a low of $263.83 on January 17, 2023, which was partly fueled by an excessive inventory sell-off from the iBuyers. Since January 2023, prices have been generally moving higher. We were at $279.86 one year ago and prices have risen 7.3% over the last 12 months.

They would only have to rise by 2% to establish a new all-time high

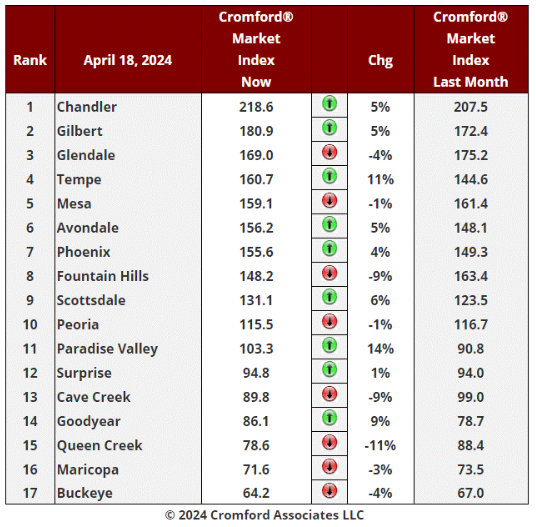

Apr 18 - Here is our latest table of Cromford® Market Index values for the single-family markets in the 17 largest cities

The average change in CMI over the past month is +1.1%, up from +0.3% last week.

We have 9 cities showing an increase in their Cromford® Market Index over the past month, while 8 have declined. This is worse than last week. Mixed signals again.

Tempe, Goodyear and Paradise Valley are the biggest moves in favor of sellers, followed by Scottsdale. Fountain Hills, Queen Creek, Cave Creek are the primary locations moving in favor of buyers. Buckeye remains adrift at the bottom of the table while Chandler is still way out in front at the top. Gilbert is attempting to challenge Chandler while Queen Creek has joined Maricopa below the 80 level.

10 out of 17 cities are seller's markets. We have 2 cities that are balanced, while 5 are buyer's markets. This mix is weaker than last week thanks to Cave Creek moving from balanced to a buyer's market.

Apr 17 - This observation is from Callum Williams at the Economist. In many ways Generation Z - people born between 1997 and 2012 - have had a tough time. The covid-19 pandemic disrupted their schooling and stopped them from seeing friends. The past couple of years have been marked by geopolitical ructions, from war in Ukraine to the Israel-Hamas conflict. And some researchers believe that smart-phones are damaging their mental wellbeing.

So far, so bad. But as we report this week, there is another side to the story. Gen Z is rich. Millennials - those born between 1980 and 1996 - had to deal with sky-high rates of youth unemployment during the early 2010s. Gen Z-ers, by contrast, look for work during a global labor shortage. Youth unemployment is at its lowest in decades. Gen-Z job-hunters are able to demand much higher wages.

Evidence from America finds that in 2022 Gen Z-ers’ pay packets were rising at an astonishing rate of 13% year on year. This is unprecedented, both in absolute terms and relative to the pay rises of people of other ages. Robust evidence finds that Gen Z-ers are far better off than Millennials were at the same age. We find similar evidence elsewhere in the rich world.

The obvious counterargument relates to housing and education. Aren’t these pricier than ever? On education, possibly not. Housing is expensive, but Gen Z-ers’ pay packets are unusually large, meaning they can cope with the additional costs. Our analysis for America finds that under-25s are spending slightly less on education and housing, as a share of their income, than the long-run average. Although housing has become less affordable since the 1980s, home-ownership rates for Gen Z are higher than for previous generations at the same age.

Gen Z-ers’ economic advantages may not last for ever. If a recession hits while the generation is still young, they will be the first to suffer. Artificial intelligence is potentially a big threat to livelihoods. But for now, things are looking good.

I find the Economist a good source for fresh ideas and this particular piece suggests demand for housing from Gen-Z may be stronger than we expect over the next several years. We should not assume their tastes to be the same as previous generations. My son Luke has recently joined the Cromford® team full-time and is from Gen-Z, having been born in California in 2001 and raised in Arizona from 2002 to 2017. He has dual citizenship (USA and UK).

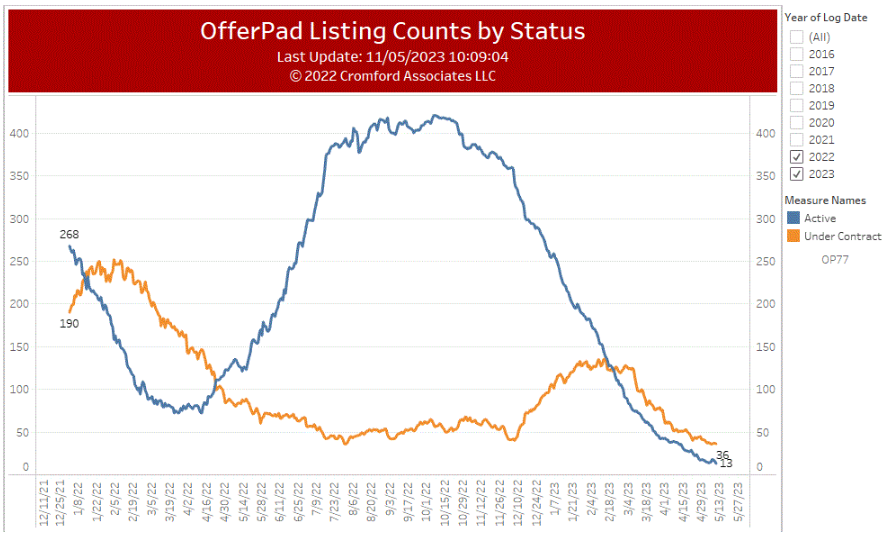

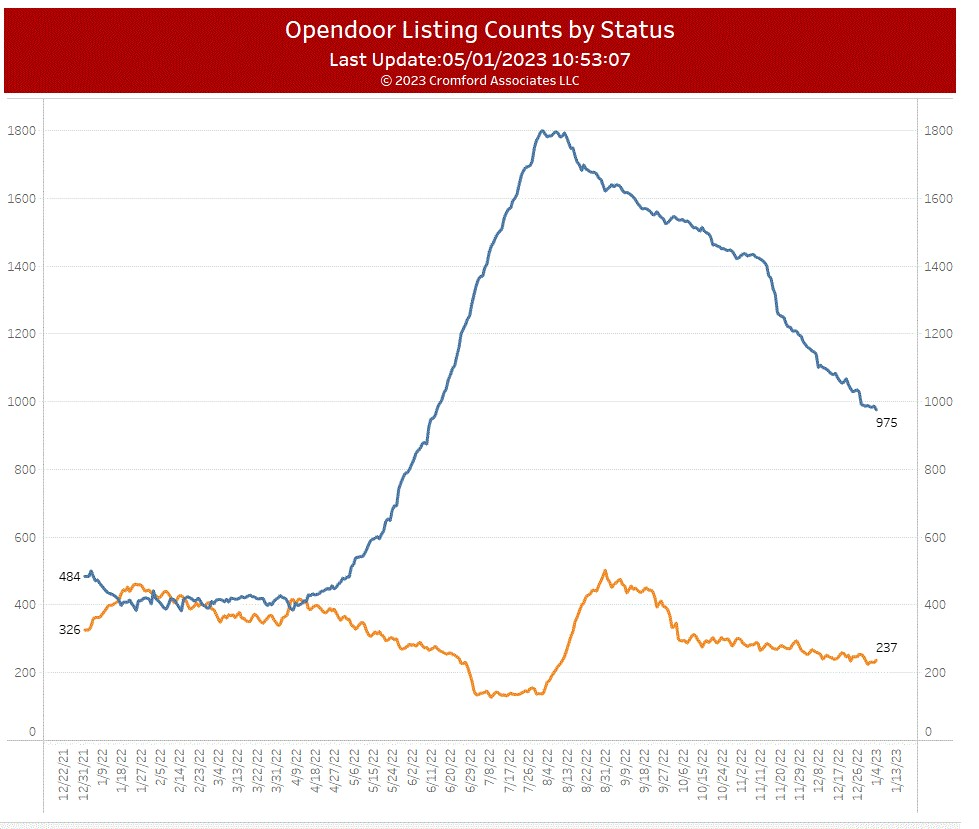

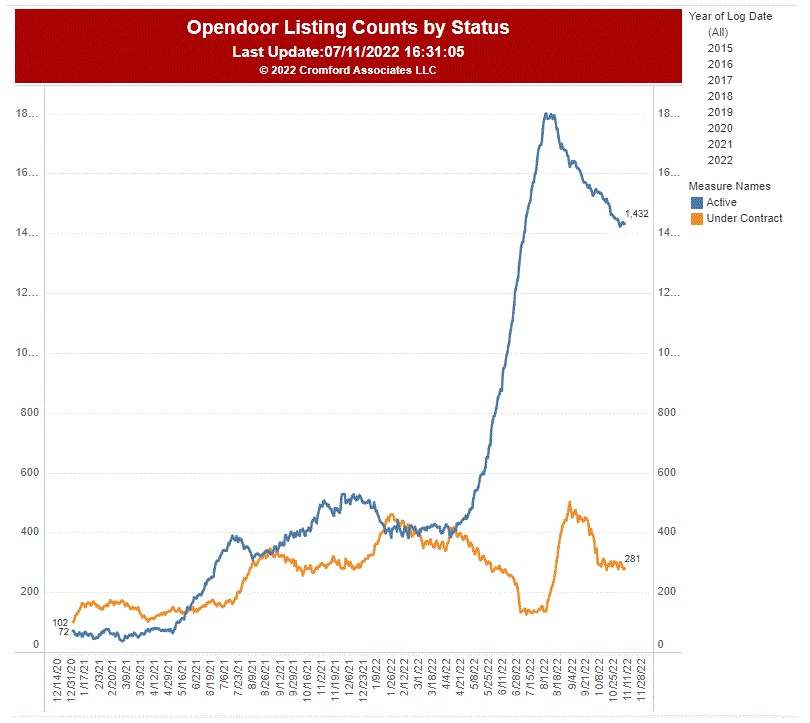

Apr 14 - I have not had a question or comment about the iBuyers in over a year now, but they have not gone away. Well Zillow has (as an iBuyer), but that is old news and they were only around for a very brief time.

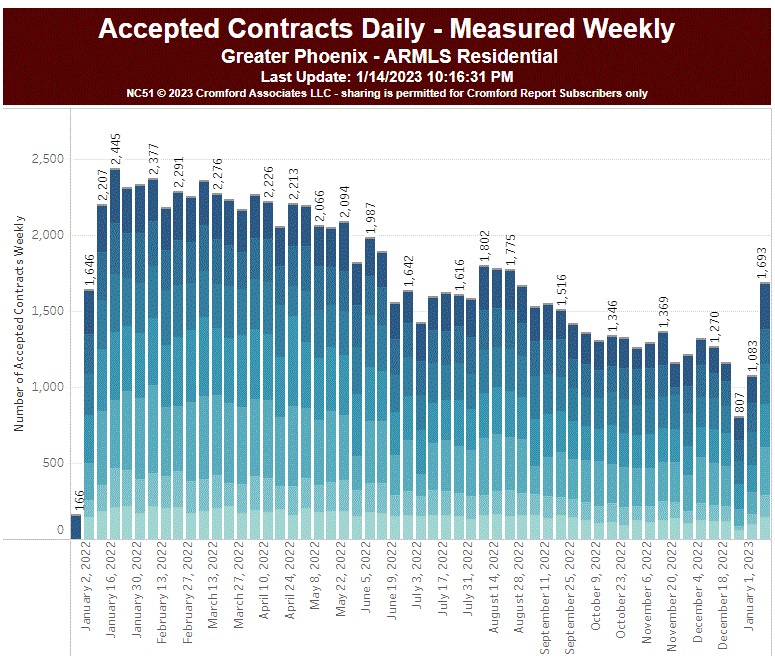

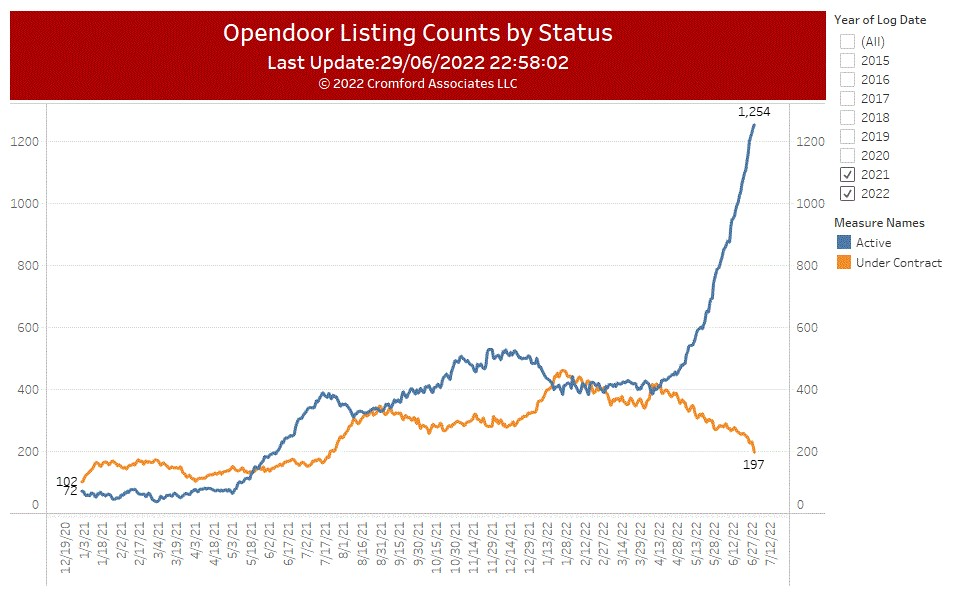

Opendoor has been selling about 40 homes a month in Greater Phoenix. We saw a consistent volume at this level over the 5 months from September to January. But in February that popped up to 63. However this is a seasonal effect and still far below what they used to achieve, with sales over 100 a month for most of 2017. Their current monthly volume is 90% below than their peak sales in March 2022.