Blog > March 2023 Phoenix Housing Market Repoert

After 200% Increase, Supply Still Nearly 40% Below Normal

Near Market-Wide Seller's Market, Prices in Most Cities Increasing

Buyer's Perspective:

The real estate market has experienced an increase in mortgage rates, rising from 5.99% to 7.1% between February and March, leading to a decline in contracts to 9,001, the fourth-lowest count since 2005. This has caused a slowdown in demand, affecting both buyers and sellers. The Arizona Regional MLS has recorded its lowest listings in 23 years. Despite these challenges, there is still an opportunity for first-time homebuyers to achieve homeownership. The FHA's recent reduction in mandatory mortgage insurance premiums can offer borrowers an additional $100 off their monthly payment, along with the higher FHA loan limit of $530,150 for 2023.

While higher rates may discourage some buyers, this market presents a unique opportunity for those who act now. By taking advantage of incentives like seller-paid rate buy-downs and down payment assistance, buyers can make their dream of homeownership a reality. Additionally, buyers can consider refinancing later at lower rates when they become available, making the current market a potentially lucrative investment opportunity.

Sellers are also encouraged to remain open-minded and consider creative solutions to attract buyers, even in a slowing market. In conclusion, while the current market may pose some challenges, there are still opportunities for both buyers and sellers to make the most of this unique time.

Seller's Perspective:

The current Greater Phoenix housing market presents a unique opportunity for homeowners looking to sell their property. With low-level demand and even lower-level supply, the market has shifted in favor of sellers. While it may not be as crazy as the last two years, sellers can still expect to benefit from the modest 3.5% increase in sale price measures since coming out of a buyer's market last December.

However, it's important to note that selling a property for over the average price and in under the average time requires a great deal of skill and experience from a competent listing agent. With fewer new listings hitting the market, sellers have less pressure to reduce their list price. As a result, weekly price reductions are falling, with only 13-14% of inventory issuing a price reduction last week compared to 25% of inventory last October. The average negotiation is 97.4% of the last list price this month, an improvement from 96.5% in January and in line with the pre-pandemic market of 2019.

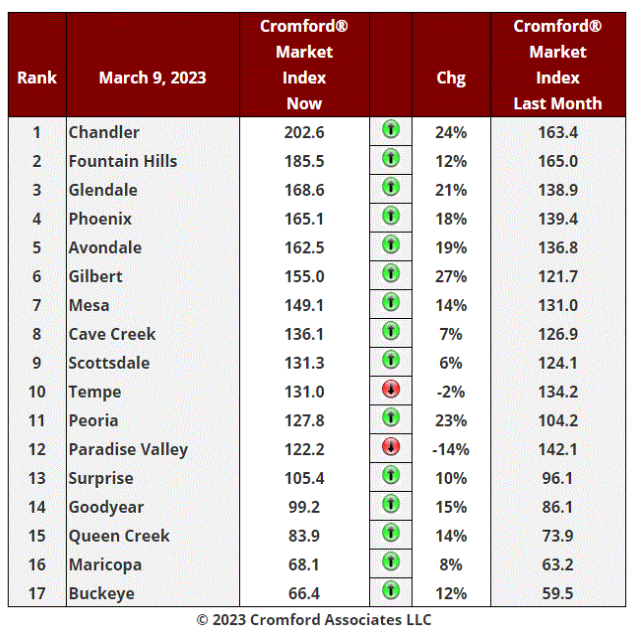

In addition, most seasonally-adjusted housing measures reflect a weak seller's market similar to 2015 where properties appreciated an average of 4.6% annually. The majority of cities in Greater Phoenix are now in seller's markets, with only 5 cities remaining in buyer's markets at this stage. The outskirts of town tend to be the first to enter buyer's markets and the last to come out, but even these cities have improved 8-14% over the past month.

In conclusion, if you're a homeowner looking to sell, now is the time to take advantage of the low levels of inventory in the Greater Phoenix housing market. However, it's crucial to be extremely picky about who you hire as your listing agent, as it requires an experienced professional to sell a property for over the average price and in under the average time.

Chandler #1 Hottest Seller's Market

Buckeye #1 Buyer's Market

(Score of 100 = Balanced Market; Over 100=Seller's Market; Under 100=Buyer's Market)

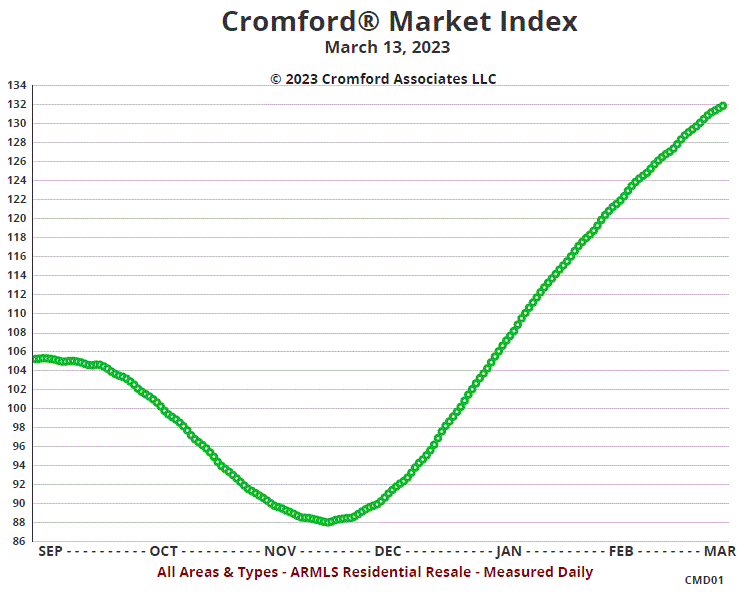

Market Average (Score of 100 = Balanced; Over 100=Seller's Market; Under 100=Buyer's Market)